The IPO or “Initial Public Offerings” market — more commonly known as the new issues market — has gone through an extraordinarily bad time this year. It’s been bad for all three of the groups that take part in this market. They are as follows:

Investors who put their money in new issues have lost substantial sums in the past year. On average, new stock issues tend to do worse than the rest of the market in their first few years of public trading. This past year, they performed much worse than ever.

Financial institutions that bring new issues to market for sale to investors have suffered, too, because demand for new issues has dried up. At this time of year in 2021, the new issues market had raised around $100 billion. So far this year, it has raised just $5 billion. In the past quarter century, the new issues market raised an average of $33 billion at this point in the year.

Companies that raise capital for themselves through the new issues market are suffering as well. When the new issues market began drying up as a source of corporate funding, many would-be issuers of new stocks found it was harder and more expensive than ever to find alternate sources of financing.

This will be worst year for IPOs since 2009

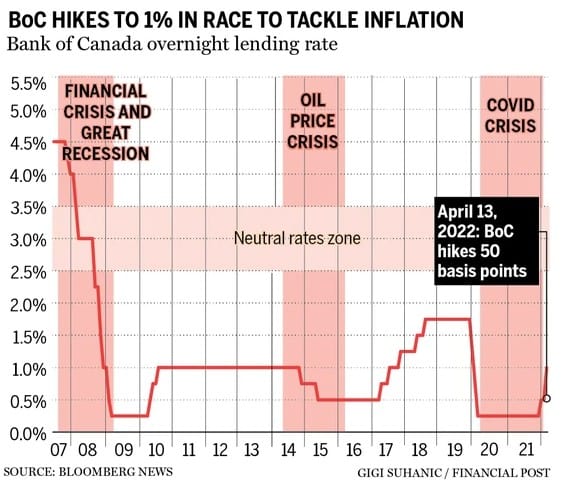

This will be the worst year for raising money in the new issues market since 2009, when the economy was struggling to pull out of the 2008/2009 recession.

As long-time readers know, we generally advise staying out of new stock issues. After all, there’s a random element in the success or failure of every business, especially when it’s just starting out. But new issues expose you to a special risk that you avoid with stocks that have been trading publicly for some time. That is, you can only invest in new issues when they come to market.

This is just one more example of a conflict of interest, which we’ve often referred to as the worst source of risk you face as an investor.

Companies only come to the new issue market to sell their stock when it’s a good time for the company and/or its insiders to sell. The insiders can’t predict the future, of course. However, they do know much more than outsiders do about their company. Continue Reading…