By Beau Peters

Special to the Financial Independence Hub

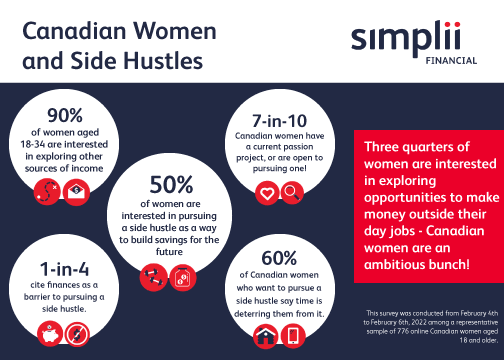

Side hustles are becoming more popular than ever. As technology advances, e-commerce stores and selling platforms like Etsy have made it possible for people to monetize their creative hobbies and turn them into viable businesses.

Even if you don’t want to run a full-fledged business, the hobby you love could end up becoming a successful side hustle if you’re willing to put in a bit of time and effort. Whether you want a little extra cash each month or you’re trying to build a brand name for yourself, selling your creative products online can help you find financial independence: and have fun doing it!

So, whether you’re into photography, pottery, crocheting, or drawing/painting, chances are there’s an audience out there that would love to purchase your creations.

Let’s take a closer look at how you can monetize your creative hobbies and make a profit doing what you love.

Think of yourself as a Business

The best thing you can do as you work to monetize your hobbies is to think of what you’re doing as a business. Even if you’re only working on it part-time for a little extra income, you’ll end up being more successful with a business mindset. That includes understanding things like:

- Finances;

- Marketing;

- Sales

- Customer service

You’ll also want to make sure you understand how creative operations work. Even if you’re doing everything on your own, creative operations will make it easier for you to manage your workflow and optimize every step of what you’re doing. When you’re putting time into a side hustle, every second counts. Creative operations make it easier to produce high-quality work as efficiently and effectively as possible.

Consider whether you can commit to the business side of your side hustle. You don’t need to devote all of your time to it, but if you want to make money and build up a following, having certain business practices in place is important. It’s also crucial when it comes to keeping things organized and keeping your finances in order. You don’t have to have a marketing degree to market your side hustle. However, if you’re not sure about running your side hustle like a business, consider hiring someone on a part-time basis to keep things moving forward and to ensure you’re staying organized.

Find Financial Freedom

It’s estimated that 40% of Americans currently have a side hustle. The uncertainty of the COVID-19 pandemic caused many people to start freelancing or forced them to look for ways of bringing in extra income. Even in a post-pandemic society, the popularity of side hustles continues to grow, especially for those who love what they’re doing. Continue Reading…