By Dale Roberts, CutTheCrapInvesting

Special to the Financial Independence Hub

I was a panelist for the Best ETFs in Canada. That was an incredible experience and I thank Jonathan Chevreau and MoneySense for the opportunity. When you land on that page you can have a look at the full panelist list, and the bios. It’s an incredible list of ETF experts and of course I am humbled to be included.

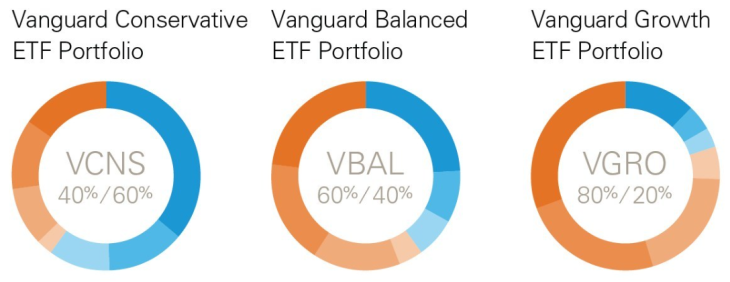

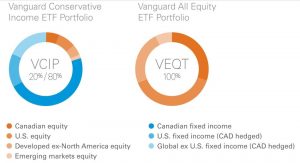

From that main landing page simply hit those buttons to have a look at the ‘Best’ Canadian, US, International and Fixed Income offerings. The all-in-one ETFs page includes those popular asset allocation ETFs that deliver ‘complete’ and well diversified and re-balanced portfolios with annual fees in the range of .20%. As Robb Engen of Boomer and Echo offered ‘those ETFs are a game changer’.

Do you really even need to get into the minutia of each individual assets for each region and each fixed income offering? We know that our basic asset allocation; the overall mix of Canadian to US to International stocks plus the ratio of stocks to fixed income will take care of the bulk of our returns and risk characteristics. Many investors are embracing these one ticket solutions, they’ve pulled in considerable assets in quick order. Here’s a little help on how to select the ‘right one’. Please have a read of Which Vanguard All-In-One, One-Ticket Portfolio Should You Invest In?

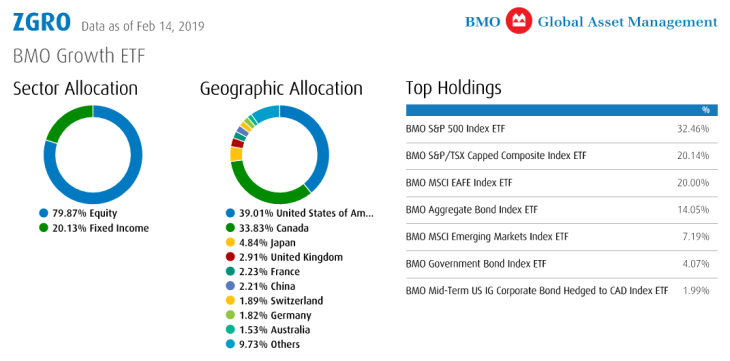

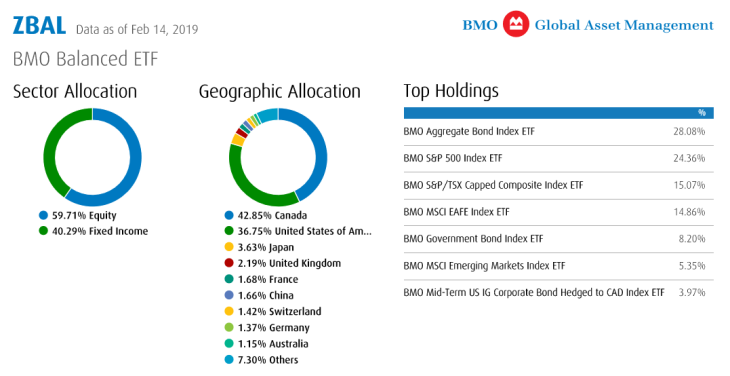

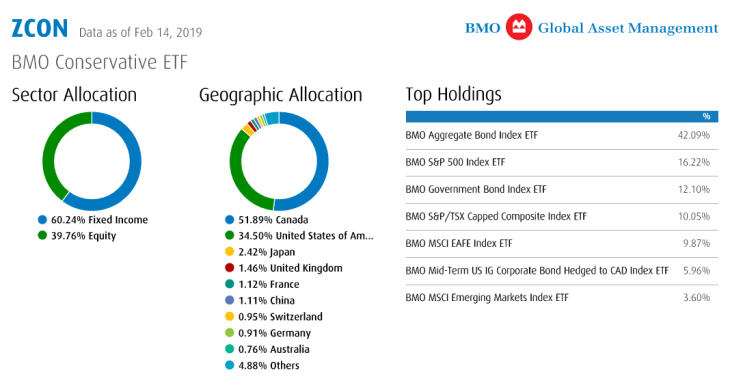

Vanguard got the nod from the MoneySense panel. That said, the offerings from iShares and BMO are all great. They have some slight differences with respect to asset allocation. Here’s BMO Keeps It Simple With Their One-Ticket Solutions.

But of course the self-directed investor will often want to shape their own portfolio. They may be able to order and arrange assets for greater tax efficiency. We can select ETFs that allow us to avoid US withholding taxes. We can create portfolios with greater growth potential. Many self-directed investors want control.

Not a lot of change, but change is a coming

As Jonathan Chevreau notes in the overview “Despite some major changes in our panel of experts, this year’s ranking has in the main affirmed most of our “All-star” picks from previous years and in particular 2018.” This is plain vanilla, couch potato investing for the most part. It’s supposed to be boring. The lists include broad-based market indices and many core bond offerings. There is nothing ‘too exotic’ going on here. With fees at a rock bottom level, it’s difficult to replace the core large cap or total market index funds.

But what about that change that might be on its way?

Indexing does not have to be plain vanilla. We might be able to arrange our portfolios to deliver greater returns or better risk adjusted returns. Retirees might be able to create a wonderful mix of income and growth that delivers more generous and more reliable retirement funding. Indexing can deliver on that factor-based investing that can include the size premium (small and mid cap and equal weight), lower volatility, value, quality and more. For now, those types of funds are not on the lists but I would not be surprised to see new categories created to cover the spectrum.

I would also like to see REITs and foreign bonds included in the mix.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print