Year to date the TSX is down more than 13%.

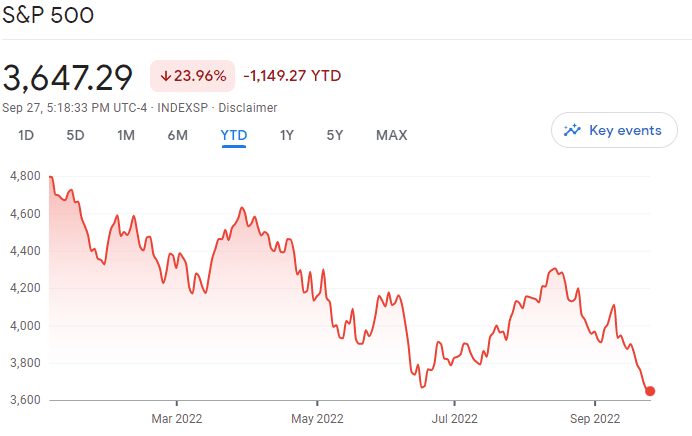

Meanwhile, the S&P 500 is down more than 22% year to date.

The typically high-flying NASDAQ is down more than 30% year to date.

For those investors who only started investing in 2021 or those who are used to the only-going-up-bull-market condition, the recent downward trend is undoubtedly hard to stomach.

Given that we’ve been DIY investing for more than a decade, some readers have reached out and asked what we’re doing in this bear, beet-red market condition.

So what are we doing?

Allow me to explain.

Think long term

First of all, it’s essential to think long term. If you’re still in the accumulation phase, like us, you should be wishing and hoping for an extended bear market.

Why?

Because investors in the accumulation phase will want to buy stocks at discounted prices.

How often do you see the likes of Royal Bank and TD having an initial dividend yield of over 4.1%? The 10-year historical average dividend yield for Royal Bank is 3.92% while the 10-year historical average dividend yield for TD is 3.8%.

Let’s not forget that TD has been paying uninterrupted dividends since 1857 and Royal Bank has been paying uninterrupted dividends since 1870.

If the share price continues to drop, the starting dividend yield will continue to go up. It’s unfathomable to see Bank of Nova Scotia and CIBC having dividend yields of over 6% and 5.5% respectively. In case you’re curious, BNS’s 10-year historical average dividend yield is 4.4% and CIBC’s 10-year historical dividend yield is 4.8%.

Furthermore, many blue-chip Canadian dividend stocks have been taking a beating lately and are entering price points that are quite attractive in terms of overall valuation and future growth. If the market stays flat for a while or continues to go down and you buy more shares now, in a few years when the market recovers, I think you will be quite pleased.

Imagine purchasing Royal Bank during the financial crisis when the sky appeared to be falling. If you were convinced back then that Royal Bank was a bargain at around $30 in 2009 and the company would continue to make billions in net income each quarter, and it would continue to pay uninterrupted dividends for the foreseeable future, buying Royal Bank back then made a lot of sense just as long as you had a long term view.

If you had done so and bought Royal Bank at around $30, you’d be looking at a hefty profit! Not to mention all the dividends you’d have collected over the years.

Yes, the sky seems to be falling again due to the ever rising interest rates and people are worried that we’d face similar stock market stagnation like Japan.

For now, I’m putting my trust in the Fed and the Bank of Canada. I believe they have learned from what Japan did in the past and won’t make the same mistakes. Therefore, I’m not as worried about potential stagnation. Instead, I think the current bear market will continue for maybe another six months or a year and the market will eventually recover.

But as I said, I’m secretly hoping the bear condition will last for a while so we can continue to buy stocks at discounted prices.

Buying regularly – dollar cost average

Another key action we’re doing is buying regularly. In the last number of years, we’ve been saving money every pay cheque and using the saving to purchase dividend-paying stocks and index ETFs every month. Some months the amount is higher and some months the amount is lower, but the important thing is that we’re investing regularly.

By buying dividend-paying stocks and index ETFs regularly, we are taking advantage of dollar cost averaging.

In addition, we enroll in DRIP whenever we’re eligible. By dripping either quarterly or monthly, we are adding more shares and taking advantage of dollar cost averaging as well.

The beauty of the dollar cost average is that if the market is down, we’d buy at a lower price, and possibly more shares in our DRIPs too; if the market happens to be up, we’d buy fewer shares.

In case you’re curious, below is what we’ve purchased so far in 2022.

| Ticker | Shares | Month Purchase | Accounts |

| SRU.UN | 203 | Jan | TFSA |

| GRT.UN | 64 | Jan | TFSA |

| ENB.TO | 320 | Jan | Reg |

| AQN.TO | 387 | Jan | RRSP |

| BEPC.TO | 26 | Jan | RRSP |

| AAPL | 16 | Feb | RRSP |

| CM.TO | 32 | Feb | RRSP |

| BCE.TO | 58 | Mar | Reg |

| POW.TO | 157 | Mar | TFSA |

| BMO.TO | 61 | Mar | Reg |

| AAPL | 7 | Mar | RRSP |

| SBUX | 10 | Mar | RRSP |

| BMO.TO | 15 | Apr | Reg |

| BMO.TO | 11 | Apr | Reg |

| BNS.TO | 25 | May | Reg |

| BCE.TO | 28 | May | Reg |

| BCE.TO | 33 | May | Reg |

| COST | 2 | May | RRSP |

| CM.TO | 56 | May | Reg |

| AAPL | 11 | May | RRSP |

| XAW | 111 | Jun | Reg |

| MFC | 105 | Jun | Reg |

| MFC | 193 | Jul | Reg |

| BLK | 4 | Jul | RRSP |

| BMO.TO | 40 | Aug | Reg |

| BCE.TO | 102 | Aug | Reg |

| BCE.TO | 104 | Aug | TFSA |

| BMO.TO | 9 | Aug | TFSA |

| CM.TO | 32 | Sep | Reg |

Yes, we have deployed a lot of dry powder in the past year. Yes, we’re in beet-red territory, seeing a paper loss of over 11% at the time of writing. But if we continue buying every month and dollar cost average, I truly believe we’ll be OK in the long run.

Keeping it simple

I believe the biggest mistake that many investors make is using complicated investing strategies, like swing trades, channel breaking, seasonality, Fibonacci sequence, etc. Your portfolio is like a bar of soap, the more you touch it, the smaller it gets. So by using complicated investing strategies, more often than not, you’re hurting yourself.

I certainly have made the same mistake in the past.

Nowadays I believe in keeping it simple – I want to be an owner, I want to own companies that make products that I rely on on a daily basis, and the more reliant I’m on the products the better.

Furthermore, it is important to stay curious and learn about companies that you own or may be interested in.

If you invest in a highly profitable company that provides unique services or makes unique products and has a wide moat, there’s no reason why the company can’t continue to make millions in profit.

Dear readers, what are you doing in this bear beet-red market condition? Are you doing something different than us?

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on Oct. 10, 2022 and is republished on the Hub with permission.

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on Oct. 10, 2022 and is republished on the Hub with permission.