Ottawa has just released its federal Budget 2022, which seems to validate the pre-release fears that a de facto Liberal NDP coalition would be a high-spending, high-taxing affair. You can find the full budget documents at the Department of Finance web site here. It is as expected “a typical NDP tax-and-spend budget,” as interim Conservative Leader Candice Bergen told the CBC.

Budget 2022 is unmemorably titled A Plan to Grow Our Economy and Make Life More Affordable, weighing in relatively slim by federal budget standards: just shy of 300 pages. Of course, the NDP is all over this document, which is why I call the de facto coalition the LibDP.

Naturally, the NDP’s pet priority is included, with $5.3 billion over 5 years for national dental care. As CTV reported, the program will offer dental care to families with annual incomes below $90,000, with no co-pays for those under $70,000 annually in income. The first phase in 2022 will offer dental care to children under 12.

Big focus on affordable housing

Of the $56 billion in projected new spending over six years, $10 billion is going to housing over five years, with a one-time $500 payment to those struggling with housing affordability. And as expected, foreign buyers will be shut out of the market for condos, apartments, and single residential units for the next two years.

They are also cracking down on home flippers, introducing new rules as of January 2023, such that if anyone sells a property held for less than 12 months it would be considered to a flip and be subject to full tax on their profits as business income (with some exceptions in certain special cases).

National Defence will get $8 billion over 5 years, There’s $500 million for military aid to Ukraine and $1 billion in loans.

Perhaps we should use CTV News’ phrase and describe the spending as “targeted”:

The budget proposes $9.5 billion in new spending for the 2022-23 fiscal year — with the biggest ticket items focused on housing supply, Indigenous reconciliation, addressing climate change, and national defence — while also set to take in more than $2 billion in revenue-generating efforts.

New “Minimum Tax Regime”

CTV reports that Budget 2022 “puts high earners on notice that the government thinks some high-income Canadians aren’t paying enough in personal income tax.” The Liberals say they will be examining “a new minimum tax regime, which will go further towards ensuring that all wealthy Canadians pay their fair share.”

Here is the Globe & Mail’s initial overview (paywall.) Or click this headline:

According to the Globe, the planned bank tax is different from the initial proposal from the Liberal’s 2021 election platform: rather than a three percentage point surtax on earnings over $1-billion, the budget announces a 1.5 percentage point increase on taxable income over $100 million. That brings the tax rate on those earnings from 15% to 16.5%.

In addition to $4-billion for cities to build 100,000 new homes, Ottawa will provide tax-free home savings accounts of up to $40,000. Future first time homebuyers will get an RRSP-style tax rebate when they contribute and the money can grow tax free. First-time homebuyers will also get a tax credit of $1,500 and a home renovation tax credit of up to $7,500 to help families add second suites for family members.

See also Patrick Brethour’s column, which describes Budget 2022 as a “pray, tax and spend” budget. But he does report some modest tax relief for small business: modest changes to small business taxation. Small businesses currently pay a reduced rate of 9% on the first $500,000 of taxable income, less than the general corporate tax rate of 15%. “But that favorable treatment ends after a business’s capital employed in Canada reaches $15-million. The budget proposes to boost that threshold to $50-million, with an estimated $660-million in tax savings over five years, starting in fiscal 2022-23.”

How it affects your pocket book

The Globe’s Erica Alini looks at how the 2022 federal budget affects homebuyers and consumers.

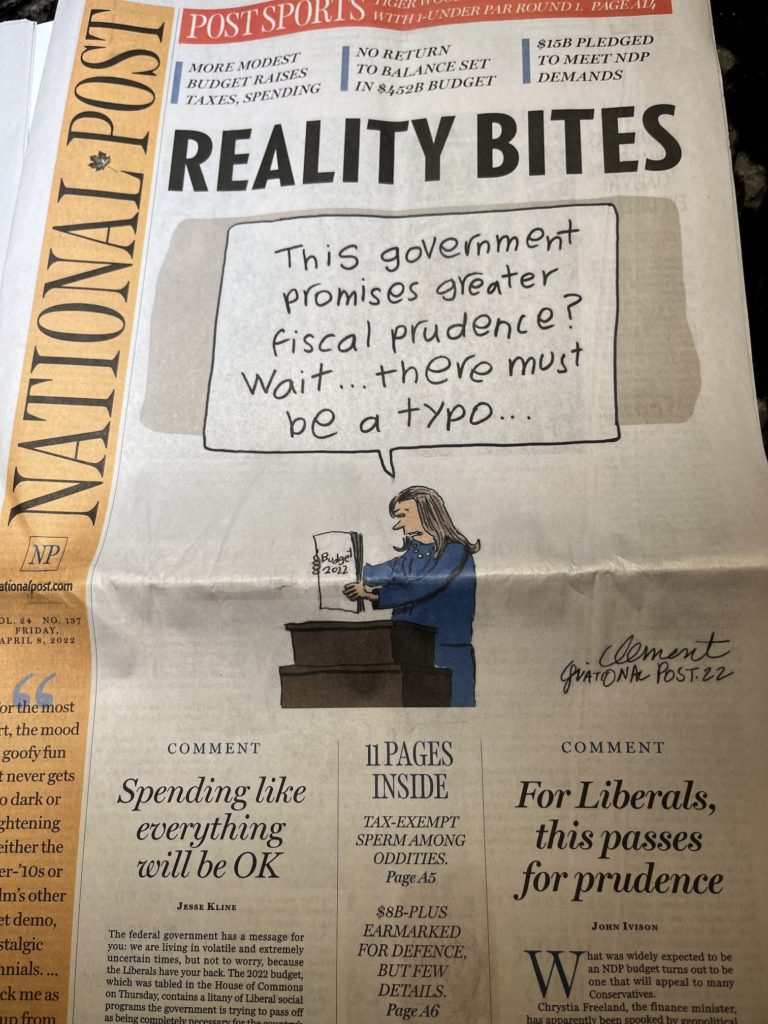

Here is the National Post’s first take. It begins by noting “The Liberals cut back on some of their many campaign promises last fall and will not meet NATO’s defence targets in order to provide a declining debt-to-GDP ratio.”

National Post columnist John Ivison is fairly kind about the budget: “We have what appears to be a prudent, responsible budget.” What was expected to be an NDP budget may appeal to many Conservatives, he writes:

To be sure, the NDP’s demands on dental care and housing are in the budget. But they are overshadowed by a spending plan that is relatively — at least in comparison to its profligate predecessors — prudent and responsible.

The budget paints the picture of an economy that is surging, with double-digit increases in commodity prices boosting government coffers. Over the next five years, Ottawa expects revenues to be $85 billion higher than it anticipated at the time of the fiscal update last fall.

The Financial Post leads with this headline (link highlighted text): Trudeau takes aim at foreign home buyers, promises supports for young Canadians in federal budget 2022

CIBC’s Golombek on how Budget 2022 tax measures impact individuals

The Post’s tax columnist — CIBC Private Wealth’s Jamie Golombek — has a good roundup of Budget 2022’s tax measures and how it affects individual taxpayers. He starts by tackling the Alternative Minimum Tax (AMT), which has been around since 1986, but hasn’t been substantially updated. He says Ottawa will be exploring a new minimum tax regime, expected to be unveiled in the fall 2022 economic update.

“It also plans to introduce a new Multigenerational Home Renovation Tax Credit, which would provide a 15-per-cent refundable credit for eligible expenses (up to $50,000) incurred for a qualifying renovation that creates a secondary dwelling unit to permit an eligible person (a senior or a person with a disability) to live with a relative.”

My take

On Thursday, the Globe’s Andrew Coyne wrote a timely pre-budget column titled The era of big government is over. The era of even bigger Government has begun.

It seems clear that with three years clear sailing for the LibDP, the ultimate choice is a stark one, nicely illustrated by the image below. I see no signs that spending will be cut, so it seems inevitable that sooner or later we’ll be going down the road shown on the left. (in both senses of the word!).