Canadian retirees and would-be retirees who feel starved of high monthly income and are pressed by surging inflation may find relief in a unique new “Best Ideas” fund-of-funds Income ETF that began trading on Feb. 16th.

Harvest Portfolios Group Inc. announced on Wednesday the completion of the initial offering of Class A Units of the Harvest Diversified Monthly Income ETF, which is now trading under the ticker symbol HDIF [TSX.]

In a press release, Harvest president and CEO Michael Kovacs said the new ETF targets a high initial annual yield of 8.5% by accessing “five proven Harvest Equity Income ETFs efficiently in one single ETF.” In a backgrounder on its website, Harvest noted the inflation-busting 8.5% compares to a 4.5% Canadian inflation rate that ended 2021, and to the TSX’s 2.6% annual yield and S&P500’s 1.5%.

As outlined in a prospectus filed Feb. 4th with all provincial securities regulatory authorities in all Canadian provinces and territories, the innovative new ETF brings together five different Harvest “Best Ideas” in generating income, and is designed to provide Canadian investors access to a core diversified monthly income solution.

The portfolio is comprised of more than 90 large global companies diversified across these 5 equally weighted sectors: Healthcare, Technology, Global Brands, Utilities, and US Banks. The five underlying ETFs are illustrated below: There is no additional management fee apart from the MERs of the underlying Harvest ETFs. Because it’s a new fund and because of the leverage component, there is not yet an estimate of what the final MER might be. But it should be in the ballpark of some blend of the MERs of the underlying funds: Referring to the tickers below, here are the Management Fees and MERs of the component Harvest ETFs, as of June 30, 2021:

HHL 0.85%/0.99%

HTA 0.85%/0.99%

HBF 0.75%/0.96%

HUBL 0.75%/0.99%

HUTL 0.50%/0.79%

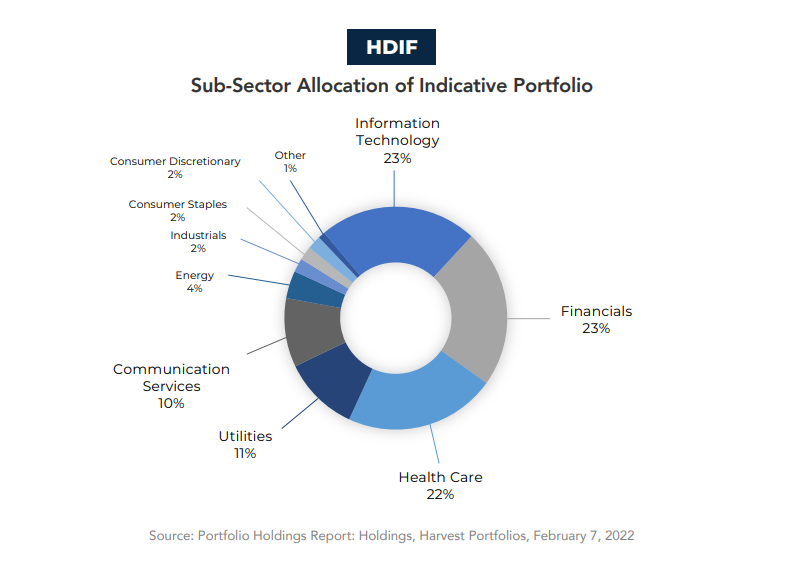

The net result is a collection of global stocks that are allocated in the following sectors (a comparable geographical breakout is not yet available):

In addition to high monthly cash distributions the fund provides the opportunity for capital appreciation by investing, on a levered basis, in a portfolio of ETFs that engage in covered call strategies. Harvest says the maximum aggregate exposure of the ETF to cash borrowing will not generally exceed approximately 33% of the ETF’s net asset value.

For additional information, visit www.harvestportfolios.com