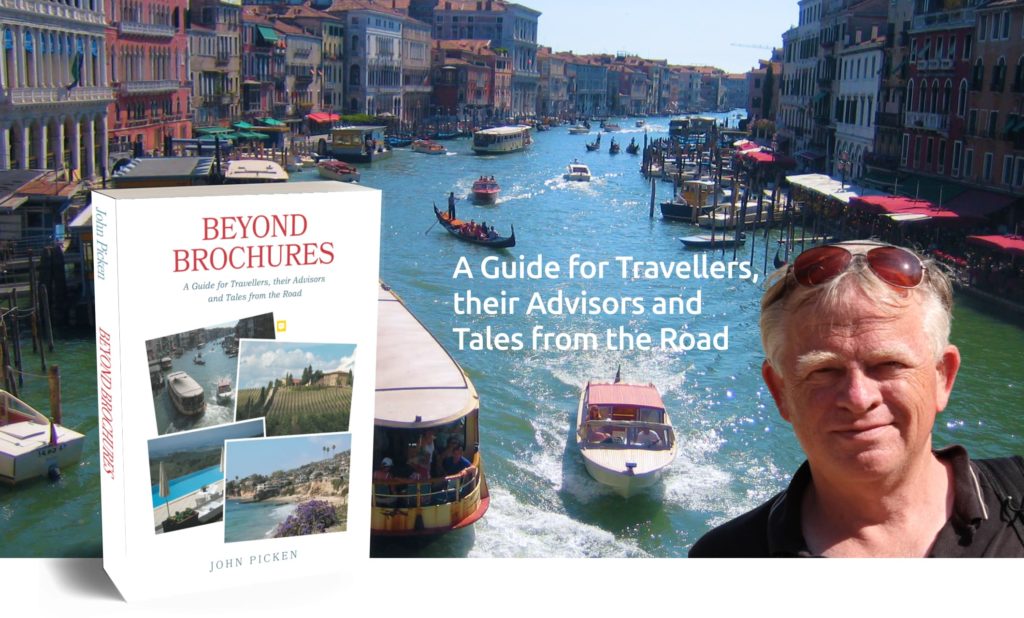

Sadly for democracy, the summer of 2021 has seen yet another flurry of books about former US president Donald Trump. The three main ones are shown in the photo above (taken from the Toronto Sunday Star’s reprint of the New York Times Book Review that appeared on August 15th, referencing late July sales).

And two more may shortly join them on the list, both by authors who have tackled this terrain at least once before: one by Bob Woodward, Peril, coauthored with Robert Costa, and Mary Trump’s sequel, The Reckoning, which came out this week, more on which below.

While we did publish a version of this blog earlier this summer I have revised it to reflect the fact that the three books already published make up three of the top six bestsellers .

Notice that all three titles originated with words originally from Trump’s mouth. I have now read or listened to all three of I Alone Can Fix It (number 1 on the adjacent list), Landslide (number 3) and Frankly, We Did Win This Election (Number 6). Thank you for the sympathy.

In the case of the three books already out and flagged above, I borrowed ebooks or audio books from the Toronto Public Library’s excellent Libby service and/or a paid service called SCRIBD: a paid service that has a 30-day free trial. Not being a Trump fan, I really don’t relish the idea of actually paying for these books, although you could also argue the authors are performing a public service in reminding American voters of the folly they committed in 2016 and may yet repeat in 2024.

I certainly hope that these five books will be the last batch but fear that we’re not even close. 45 — as I prefer to call him — grabbed an outsized share of the world’s attention during his ill-fated first term and it’s well within the realm of possibility that he will continue to do so in what may prove to be a mere interregnum of the Joe Biden presidency.

If, God forbid, 45 also becomes 47 by winning in 2024 then all told the world would be subjected to more than 12 years of his commanding the media’s attention and that of the publishing world, like it or not. The implications for the global economy and by extension the stock market are not, I think, pretty, should the worst happen.

True, 2024 may seem like a long shot, given 45’s age (75), obesity and poor dietary and exercise habits, not to mention the multiple criminal and civil legal cases unfolding against him. One hopes that eventually all this will catch up with him and that the American electorate will finally wise up to the conman/would-be dictator. You can fool some of the people all of the time but are there really 74 million Americans who are blinded to 45’s obvious faults?

So far, he’s got away with everything

Apparently so. As Mary Trump wrote in the closing pages of her book on her uncle, Too Much and Never Enough, “So far he’s gotten away with everything.” He’s dodged every bullet fired at him during his checkered career as real estate mogul, reality TV star and twice-impeached US president.

In her followup book, Mary outlines her ideas on how America can cope with the aftermath of her uncle’s chaotic four years.

Again, I read a library e-book and found the 205 pages of The Reckoning to be a fairly quick read. Roughly half the content reprises the first book and its focus on Uncle Donny. The other half, including the opening chapter, covers perhaps more American history than most Canadians will be interested in: especially its native origins and early days of slavery of Black Americans and/or a lot of analysis and recommendations for how America can emerge from the “trauma” that psychologist Mary Trump hypothesizes afflicted her and many other Americans following her uncle’s 2016 electoral victory.

Certainly, she has not dialled down her rhetoric about her uncle. A few sample passages:

She concedes that 74 million people voted for Donald, who she describes as “the least worthy person I can imagine.”

She concedes that 74 million people voted for Donald, who she describes as “the least worthy person I can imagine.”

“…. despite, or because of, the four years of incompetence, cruelty, criminality, grifting, unconstitutional behaviour, treachery, treason, and most breathtaking of all, the fact that almost there hundred thousand Americans had died by Election Day as a direct result of Donald’s willfully malicious inaction.”

Or:

“Donald wasn’t just incompetent, laughable, and cruel — though he was all of those — he was actively laying the groundwork, through his rhetoric, his policies, and his perversion of democratic norms and institutions, for autocracy.”

What has this to do with Financial Independence?

What has all this got to do with Financial Independence? At first blush, not a lot. See for example this Hub blog I wrote from 2018: The glut of books about Trump and prospects for Boomers’ retirements. If he actually wins back office from 2025 to 2029, many of his generation will be retired if they’re not already.

The last time we looked at Trump books was last fall, as we steeled ourselves for the possibility of his reelection: apart from the Mary Trump book cited above I reviewed Michael Cohen’s Disloyal and Bob Woodward’s Rage. Again, note that Woodward is about to publish Peril, another book about Trump’s last year in office, coauthored with the Washington Post’s Robert Costa.

The last time we looked at Trump books was last fall, as we steeled ourselves for the possibility of his reelection: apart from the Mary Trump book cited above I reviewed Michael Cohen’s Disloyal and Bob Woodward’s Rage. Again, note that Woodward is about to publish Peril, another book about Trump’s last year in office, coauthored with the Washington Post’s Robert Costa.

Which brings us to the three bestsellers flagged in yellow in the list at the top of this blog. Apart from them, hose interested in the Covid aspect of the Trump presidency might also want to read Nightmare Scenario. I enjoyed it, although anyone paying attention to the news throughout 2020 will be familiar with the story arc: 45’s initial and ongoing denial of Covid, his attempt to keep the stock market from being spooked by it, and on through Operation Warp Speed and Pfizer’s announcement of its successful vaccine scant days after the election, which of course infuriated 45. Mary Trump’s The Reckoning also spends a lot of time on Donald’s negligence with respect to the pandemic

Landslide

This is Michael Wolff’s third book on Trump, which in itself should be cause for pity for this author. The New York Times favourably reviewed this along with I Alone Can Fix It. Continue Reading…

This is Michael Wolff’s third book on Trump, which in itself should be cause for pity for this author. The New York Times favourably reviewed this along with I Alone Can Fix It. Continue Reading…