By Fritz Gilbert, TheRetirementManifesto

By Fritz Gilbert, TheRetirementManifesto

Special to the Financial Independence Hub

A few years ago, I was working through my decision to retire. I was pretty obsessive about it and documented the many factors I was evaluating on this blog (stored in chronological order for your convenience). After doing my homework, I decided to make the jump in June 2018.

In the four years since I’ve never regretted my decision.

The decision to retire is complicated and there are many factors to consider. Consider them you must, however, so I’m listing the factors I consider most important and one which I consider essentially irrelevant. To make your best decision on when to retire, it’s important to recognize all of the things that matter, as well as those that don’t. Under each factor, I’ve included links to relevant posts for those of you who’d like to dig deeper.

The Most Important Factors

1.) Do you have Enough Money?

The first thing most people think about when they’re making the decision to retire is whether they have enough money to last for the rest of their lifetime. Fair enough, and I’ll concede it’s way up on the list. I’d warn, however, that having enough money is a necessary factor, but far from sufficient.

I’ve written many articles on evaluating whether you have enough money to retire. Below are four that I’d recommend:

- 10 Steps To Make Sure You Have Enough Money to Retire

- The Ultimate Retirement Planning Guide

- When Can I Retire? (a 4-part series)

- Rethinking The 4% Safe Withdrawal Rule

2.) Are you Mentally Prepared for Retirement?

Almost everyone thinks about money when they’re making the decision to retire, but far too few consider the non-financial factors. If I were to choose one point to make from all the things I’ve learned in the 7 years of writing this blog, it’s that the non-financial factors are the most important for putting yourself on track for a great retirement. Important enough that I wrote an entire book on the topic.

If you’re thinking about retirement, the best advice I can give you is to spend time thinking about what you want your life to be in retirement. Think about it at least as much as you think about the “money stuff.” Once you’ve retired, I suspect you’ll realize #2 is actually the more critical factor.

If you’re married, have you and your spouse talked about your mutual expectations for your life in retirement? How are you addressing any misalignments? Trust me, you have some. Take the time to find them now, and discuss how you’re going to work together to live the best years for both of you in retirement.

What Purpose is going to fill your days when you no longer have a boss telling you what to do? Where are you going to live? What are you going to do? Important stuff, all, and a topic on which I’ve dedicated thousands of words. If you’re still working, do yourself a favor and take a “mini-retirement” to think about the things that really matter before you take the plunge.

3.) Have you made a Realistic Spending Estimate?

In its rawest form, the decision to retire is a simple math problem. Multiply your assets times a safe withdrawal rate, add any expected income, and see if the total covers your expected level of spending. Given the importance of getting the correct answer to that formula, it’s critical that you spend some time developing a realistic spending estimate for your retirement years. Since you’ve thought about what you’re going to be doing in retirement (#2), it’s a necessary exercise to track your pre-retirement spending for as long as feasible (I did 11 months), then make any adjustments for how you think it will change post-retirement. Too many people “take a swag” on this one, but I strongly encourage you to resist that temptation and give it a lot of focus as you’re making your decision to retire.

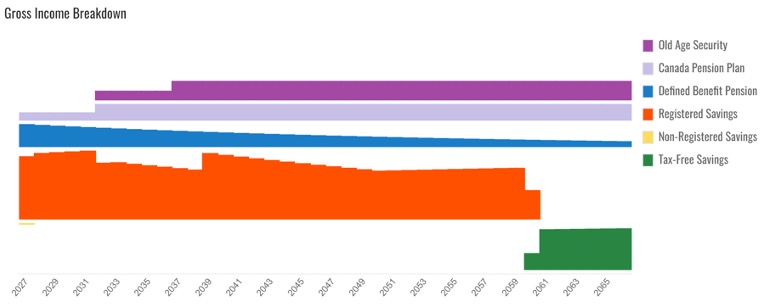

4.) Is your Portfolio Ready for Withdrawals?

One of the biggest changes you’ll face in retirement is the move from years of accumulating assets to the process of withdrawing those assets to fund your retirement. It’s a huge shift and one which you should plan for in your final year or two of work. Recognize that the skill set needed to manage withdrawals from your portfolio is entirely different than those you’ve honed during your accumulation years. Start developing the skills required to pull from your investments now. Recognize they’re important skills that you’ll be using for the rest of your life.

Also, the asset allocation you’ve maintained during your working years is likely different than the allocation you’ll need in your retirement years. For example, to avoid Sequence of Return risk, you’ll want to have your cash cushion fully in place by the day you retire. It takes some time to reposition your portfolio, so figure out your strategy and get it implemented in your last year or two of work.

5.) What’s your Risk Tolerance?

Let’s face it, there’s risk associated with the decision to retire. By definition, you are making a decision without knowing all of the answers. The future is unknowable. All things being equal, a decision to retire earlier has more risk than a decision to retire later. Are you aware of, and comfortable with, those risks?

Understanding and becoming comfortable with how much risk you’re willing to tolerate is a part of every decision to retire, whether people realize it or not. Are you comfortable relying on private insurance for a few years before your Medicare kicks in? How concerned are you about the risks of long-term care, and what are you going to do about it? Are you concerned that your investments won’t keep up with inflation? How much of your assets should you allocate to stocks vs. bonds vs. cash?

Many people think “risk tolerance” is primarily used to determine asset allocation, but I’d argue there are a lot of risk factors that need to be considered as you’re finalizing your decision to retire. For example, there’s risk that you’ll lose some great years of retirement if you delay your decision. If you’re unhealthy, that risk increases. How comfortable are you in giving up those “good years” of retirement? That’s a risk tolerance question, and exactly the type of thing you should be thinking about as you finalize your decision.

The Least Important Factor in your Decision to Retire

As you read through the list of important factors, you’ll notice one that’s intentionally missing. And yet, this factor is the one that many people think of first. Perhaps that’s because we’ve been conditioned throughout life to think of this factor when facing many of life’s milestones: Continue Reading…