I don’t claim that this plan is the best possible or that it will work for everyone. I do claim that the vast majority of people who follow different plans will get worse outcomes.

Most of my readers will be more interested in the later stages of this plan. Please indulge me for a while; the beginning lays the foundation for the rest.

Starting out

Our hypothetical investor – let’s call her Jill – is at least 18, currently earns less than $50,000 per year, and has a chequing account at some big bank. She has a modest amount of savings in her account earning no interest. It’s about time she opened a savings account to earn some interest on her savings, but big bank savings accounts barely pay any interest.

So, Jill opens an online non-registered savings/chequing account at a Canadian bank that is not one of the big banks. She chooses it because it’s CDIC-protected, transactions are free, and it currently pays much higher interest than the big banks offer. If this bank ever changes its policy on offering competitive interest rates or free transactions, Jill will just switch to somewhere else that offers better terms. It’s not worth switching for a small interest rate increase or for a limited-time offer, but if she can ever get say 0.5% more elsewhere, she’ll go.

For now, Jill probably needs to keep a chequing account at a big bank. Accounts at smaller banks sometimes need to be linked to some other bank account, and you can’t access a bank machine through most smaller banks. It’s also good to be able to talk to a big-bank teller the rare time you need a certified cheque, to make a wire transfer, or to pay some bill you can’t figure out how to pay online.

Jill also opens a TFSA at the small bank. It pays even higher interest, and she might as well earn the interest tax-free. Sometime much later, Jill may want all of her TFSA room devoted to non-cash investments, at which time she can close this TFSA. But for now her TFSA will hold some cash.

At this point Jill is learning about how TFSA contribution room works. She’ll find that it’s best not to deposit and withdraw too often because you don’t get TFSA room back until the start of the next calendar year. She should use her regular non-registered account for more frequent transactions.

This plan will work well for Jill as long as she has fairly short-term plans for her savings, such as going to school. As long as she will likely need her savings within 5 years, there’s nothing wrong with keeping it in cash earning as much interest as she can get safely and conveniently.

Let’s look at some potential distractions Jill faces on her current plan.

The bank teller says Jill should open a savings account and get a credit card.

Jill needs a good savings account, such as what some small banks offer, not a big-bank savings account that pays next to no interest. If Jill gets a credit card, she should look for one that suits her needs, not take the conflicted advice of a teller.

All the cool kids are buying Bitcoin.

Jill is level-headed enough to know that she knows next to nothing about investing, never mind wild speculation in Bitcoin, or whatever is currently holding people’s interest.

Savings Start to Grow

At some point, Jill’s savings will grow beyond what she thinks she will need within 5 years. Perhaps she has graduated, is working full time, and has no immediate plans to use all her savings as a down payment on a house. She doesn’t carry credit-card debt, has paid off her student loans, and has no other debts. We’ll assume for now that Jill has no group RRSP at work and is making less than $50,000 per year, so that she’s not in a high tax bracket and has no reason to open a self-directed RRSP.

Jill will still hold some cash savings she might need in the next 5 years in her small bank savings accounts. Now it’s time to start investing in stocks with her longer-term savings. Jill knows that stocks offer the potential for great long-term returns, but she has no idea which ones to buy. Fortunately, she’s heard that even the most talented stock-pickers often get it wrong, so she’s best off just owning all stocks. This may sound impossible, but the exchange-traded fund (ETF) called VEQT holds just about every stock in the world. She can own her slice of the world’s businesses just by buying VEQT. There are a few other ETFs with similar holdings, and it doesn’t matter much which one Jill picks. (I mention VEQT because it appears to be among the best available stock index ETFs right now; I get no money or other consideration for mentioning it.)

Jill opens a TFSA at a discount brokerage. It’s okay for her to have both this TFSA and the one holding just cash at a small bank, as long as her combined contributions don’t exceed the government’s limits. Any savings she adds to this new TFSA she uses to buy VEQT. That’s it. Nothing fancier.

The biggest lesson Jill needs to learn while her stock holdings are small is to ignore VEQT’s changing price. Many people hope that their stocks won’t crash. This is the wrong mindset. Stocks are certain to crash, but we don’t know when. We need to invest in such a way that we can live with a crash whenever it happens.

Jill should just add new money to her VEQT holdings on a regular basis through any kind of market, including a bear market. Trying to predict when markets will crash is futile. She needs to accept that she can’t avoid stock crashes and that prices will eventually rise again. This lesson is so important that Jill needs a different plan if she will panic and sell the first time VEQT drops 20% or more. Learning that stock crashes are inevitable and calmly doing nothing different through them is critical for Jill’s investment future. Fortunately, in the coming years, Jill will focus on the safe cash cushion in her savings accounts when VEQT’s price drops.

What distractions could throw Jill off her plan now?

The bank says they can help Jill open a TFSA and invest her money.

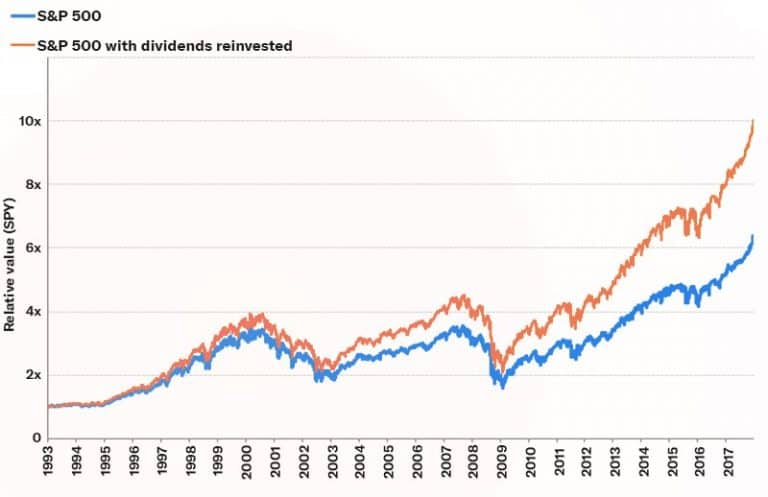

The bank is just going to steer Jill into expensive mutual funds that will likely cost her at least 2% per year, which builds up to a whopping 39% over 25 years. As incredible as it sounds, 39% of her savings and returns would slowly become bank revenue during those years. It’s no wonder that bank profits are so high. In contrast, VEQT’s fees are just 0.25% per year, which builds up to just 6% over 25 years.

The smart, sophisticated twenty-somethings are getting rich day-trading on Robinhood.

No, they’re not. We only hear the stories about rare big temporary successes, not the widespread mundane losses. Very few traders will outperform VEQT. Over the long term, Jill will be ahead of more than 90% of investors and an even higher percentage of day traders.

Investing has to be harder than just buying one ETF.

In most endeavours, working harder gives better results. With investing, you need to learn enough to understand the power of diversified, buy-and-hold, low-cost investing. Beyond that, taking courses in stock picking will just tempt you to lose money picking your own stocks.

VEQT’s price is dropping! What should I do?

Inevitably, stock markets crash. It’s hard to know how you’ll react until you experience a crash. If Jill decides she really can’t handle a sudden VEQT price drop, her best course of action is to gut out this market cycle until VEQT prices come back up, and then choose a different asset allocation ETF that includes some bonds to smooth out the ride. She can then stick with this new ETF into the future.

Rising income

Jill’s income is now enough above $50,000 per year that it makes sense to open an RRSP account at her discount broker. She also has a group RRSP at work, and she contributes the minimum amount required to get the maximum match from her employer. She would have participated in this group RRSP even if her income was lower because the employer match is valuable.

Jill figures out how much she’d like to contribute each year to her RRSP at the discount brokerage. This has to take into account her RRSP contribution limit, her group RRSP contribution as well as the employer match, and the fact that there is little to gain from reducing her taxable income below about $50,000. If she wants to add even more to her long-term savings than these RRSP contributions, she can save some money in her discount brokerage TFSA.

Next comes the decision about what to own in her self-directed RRSP. Once again, she buys only VEQT. Nothing fancier is needed, and most people won’t do as well as just owning VEQT.

When Jill looked into the details of her group RRSP, she was disappointed that the fees were so high; VEQT isn’t one of the investment options. But she can’t get the employer match without choosing among the expensive funds. So, her plan is to learn the vesting rules of her group RRSP, and once she’s allowed to transfer assets to her self-directed RRSP without penalties or losing the company match, she’ll make this transfer every year or two. She’ll be careful to make these direct transfers from one RRSP to another rather than withdrawals. However, when asking questions about the group RRSP rules, she’ll be careful not to reveal her plans to avoid the expensive fund choices. The company operating the group RRSP may become less than cooperative if they know Jill has no intention of paying their excessive fees on a large amount of savings.

So, Jill now has VEQT holdings building in her RRSP and TFSA at the discount brokerage. Her investment plan remains wonderfully simple. But there are distractions ready to push her off this plan for easy success.

All the savvy thirty-somethings are talking about dividend stocks.

Most dividend investors are poorly diversified, but it’s possible to own enough dividend stocks to be properly diversified. Does Jill really want to spend her time poring over company financial statements to choose a large number of dividend stocks? Some people like that sort of thing. Jill doesn’t. She’s better off with VEQT.

Now that Jill’s savings are growing, surely she’s ready for a more sophisticated investment strategy.

Just about everyone who tries more complicated strategies won’t do as well as just owning VEQT. Jill is best off just sticking with her simple plan. She’s not keeping it simple because she’s not capable of handling something more complex. It’s just that there’s no guarantee that a more complex strategy will perform better, and she’s not interested in doing the necessary work. Jill used to be annoyed at people with more complex strategies because it made her feel dumb to have such a simple plan. But now she just wishes these people well; she knows she has a smart strategy no matter what it sounds like to others.

Buying a home

Jill decides to buy a home in the next couple of years. The cash she has in her savings account isn’t enough for a down payment; she plans to use all of her investments in her discount brokerage TFSA as well as $35,000 of her RRSP investments through the home buyer’s plan.

Suddenly, money that she didn’t plan to use for at least 5 years has become money she wants to use sooner. So, she sells the VEQT in her TFSA, and sells $35,000 of the VEQT in her RRSP. This protects her home-buying plans in case VEQT’s price suddenly falls between now and when she buys her new home.

Jill still wants to earn good interest on her cash, so she checks out the options for cash interest at her discount brokerage. Unfortunately, the interest rates are not nearly as good as what some small banks offer in their savings accounts. So, she opens an RRSP at her small bank, and arranges for TFSA-to-TFSA and RRSP-to-RRSP transfers from her discount brokerage to her accounts at the small bank. She’s careful to make sure she isn’t making withdrawals, but direct transfers.

From now until she buys the home, she directs all new TFSA savings to cash in her small bank TFSA to build her down payment. But she won’t use all her cash on hand as a down payment, because there will inevitably be expenses with a new home.

After buying the home, she plans to direct new savings to paying down the mortgage. She’ll still participate in her group RRSP, but she won’t contribute to her TFSA or self-directed RRSP for a while. She wants to get the mortgage down to a less scary level in case mortgage interest rates rise. Once the mortgage is somewhat tamed, she’ll resume adding to her TFSA and self-directed RRSP, and she’ll invest in VEQT.

New distractions as well as the old ones are ready to push Jill away from her simple plan.

Isn’t it better to invest than pay off the mortgage while rates are so low?

(Editor’s note: keep in mind this blog originally ran in 2021.)

This is good reasoning to a point. It comes down to how stretched you are. A quick test is to calculate what your mortgage payment would be if interest rates rise 5 percentage points. If this payment would cause you serious problems, you’re probably best to pay extra on the mortgage for a while. With her life ticking along so well, Jill sees no need to add risk. Once the mortgage principal is down to a more comfortable level, she’ll resume adding to her investments. Continue Reading…