Special to the Financial Independence Hub

Should you withdraw the Commuted Value of your Defined-Benefit Pension?

No. There are some exceptions, but the answer is almost always no. In fact, if a financial advisor is pushing you to pull out the commuted value of your pension, that’s a sign that you’re likely working with a bad advisor.

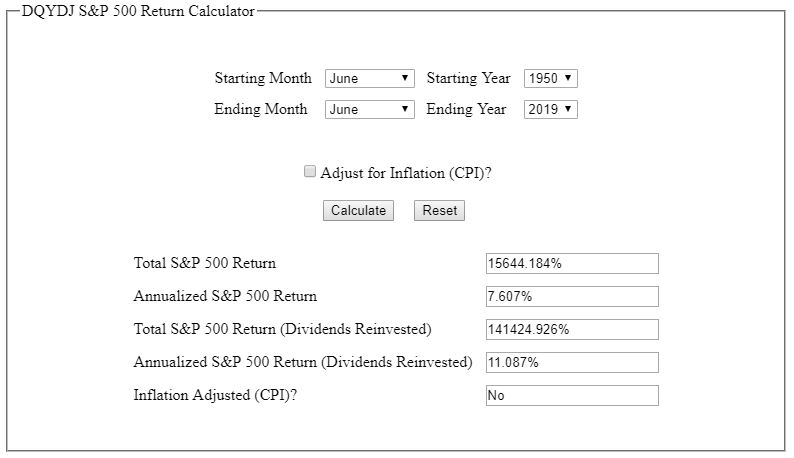

There is almost no chance that your advisor will choose investments that outperform a pension fund, mainly because the total fees you pay with an advisor are so much higher than the fees charged within a pension fund.

Some advisors will tell you that you won’t pay any fees because the mutual funds pay the advisor. Don’t believe this. Mutual funds and advisors get paid out of your savings.

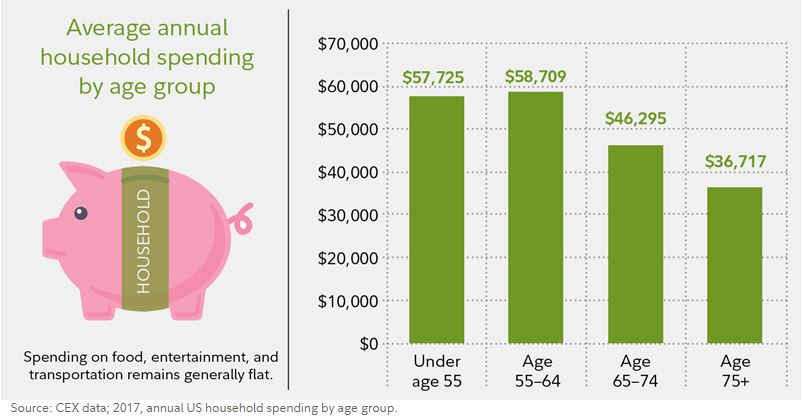

Further, defined-benefit pensions have the advantage of handling longevity risk. Pension funds can afford to pay you based on your expected life span, and they’ll keep paying if you happen to live long. With an advisor managing your money, you need to hold back on your spending in case you live long.

Where it might make sense to take the commuted value

There are some cases where it makes sense to withdraw your pension’s commuted value. Here are a few:

1. Poor health makes you likely to die much younger than average. In this case, taking the commuted value allows you to spend more now or leave a larger legacy. Continue Reading…