Below is an edited transcript of a podcast interview conducted late in 2023 between myself and Burn Your Mortgage podcaster and author Sean Cooper.

The conversation starts with our thoughts on the high price of housing in Canada and how newcomers trying to get on the first rung of the housing ladder can get a start by saving up in Tax-Free Savings Accounts (TFSAs) and the new First Home Savings Accounts (FHSAs.)

From there we move on a discussion of saving for Retirement, my concept of Findependence (or Financial Independence) and Semi-Retirement: aka Victory Lap Retirement.

Click any of the links below to hear the full audio podcast on your favorite podcast app. Below that is a shortened edited transcript of the interview.

Partial Transcript

Sean Cooper

Let’s get started with our interesting discussion today on findependence as well as your daughter’s journey to homeownership. I remember you being on a segment of CBC on the money back in the day a few years ago, with your daughter. So yes, the first thing I want to ask you about is the challenge of younger folks buying a property around that housing affordability issue, so maybe we can talk a bit about your daughter’s journey to homeownership and also about the new First Home Savings Account (FHSA.)

Jonathan Chevreau

Sure. first of all, as an only child, we remind her that eventually we’ll be gone and that this current house will be hers in any case. So that removes some pressure. Is it a challenge right now in places like Toronto and Vancouver to buy a first home? Yes, it is. Is it impossible? No, it’s like anything else in personal finance. It’s priorities. I think I’ve educated her to the point that she’s been saving in a TFSA and maximizing it since she was 18 years old.

The point is between the TFSA and now the First Home Savings Account, it’s a lot better to receive interest than to pay it out once you commit to a house, which is a lot more expensive than the baby boomers ever had to pay … We’d rather collect rent, in effect, or interest income than than pay it out.

FHSA versus TFSA and Homebuyers Plan

Sean Cooper

Could you share your thoughts on how the FHSA compares to the TFSA and the RRSP homebuyer plan?

Jonathan Chevreau

As you know, the FHSA has only been out for about a year. And it allows you to invest $8,000 a year into basically anything that an RRSP or a TFSA would allow you to invest in. So not just fixed income, but you can invest in stocks, ETFs, asset allocation ETFs, etc. And you get a deduction similar to how an RRSP generates one.

But the beauty of it is it’s very flexible, like a TFSA. You don’t have to buy a first home. But it’s only good for people who have never bought a home yet, so it’s a one-time only deal. I would say it would be a priority. But whether or not you think you’re going to buy a home, you certainly will want to retire at some point. And therefore the FHSA does double duty.

Sean Cooper

I agree completely. And the FHSA is a lot more flexible than the homebuyer plan, you can actually use both of them together. So if you have a lot of money in your RRSP, then you can use them in combination. But a couple cool things that I learned is that with the RRSP home buyers plan, there’s actually the rule that basically any contributions that you make, it has to sit in the account for 90 days before you can take the money out. But with the FHSA, it doesn’t have that same rule, you can essentially contribute money and then pretty much take it out. And you don’t have to wait 90 days or anything like that.

Jonathan Chevreau

The good thing about home equity and a paid for-home because as you know, Sean, I’ve written that the foundation of financial independence is a paid-for home, but once it’s paid for there is home equity, then, if you have to, in the last five years of Old Age would tap it to pay for, I don’t know, $6,000 or $7,000 a month for a nursing home or retirement home. Nice to have in the back of your pocket, the home equity.

My view is, there’s no rush to get out there and buy a first home at these high interest rates and home prices are also almost near record high though they’ve come down a bit.

Retirement savings, pensions, CPP, OAS

Sean Cooper

Why don’t we switch gears and talk about the second topic that we want to discuss: financial independence. If all the money is in the house, and you don’t have a gold-plated pension plan, you have a bit of a challenge there. Now, certainly you can downsize but then there is the cost of moving and the land transfer tax, and all that.

Jonathan Chevreau

Well, I don’t have a gold-plated pension. I would call it more like a bronze-plated one. Mostly from National Post, since I was there for 19 years. My wife has no employer pension, but always maximized her RRSP. And we obviously eat our own cooking, so we have maximized our TFSAs since it began. We delayed CPP as long as we could, but didn’t quite wait until 70 because actuary and author Fred Vettese had an article in The Globe the last couple of weeks arguing that those who are 68 or 69 now are probably better off taking CPP a year or two earlier, so you get the inflation adjustment.

Most financial planners would say you should look at CPP and OAS really nice additions to savings and that can be the foundation or your findependence, especially if you don’t have an employer-provided Defined Benefit pension plan. Some worry that if the worst happens, like Alberta leaving CPP, what if somehow they renege on the CPP promise? But I don’t think it’s going to happen.

Retiree money fears and Asset Allocation

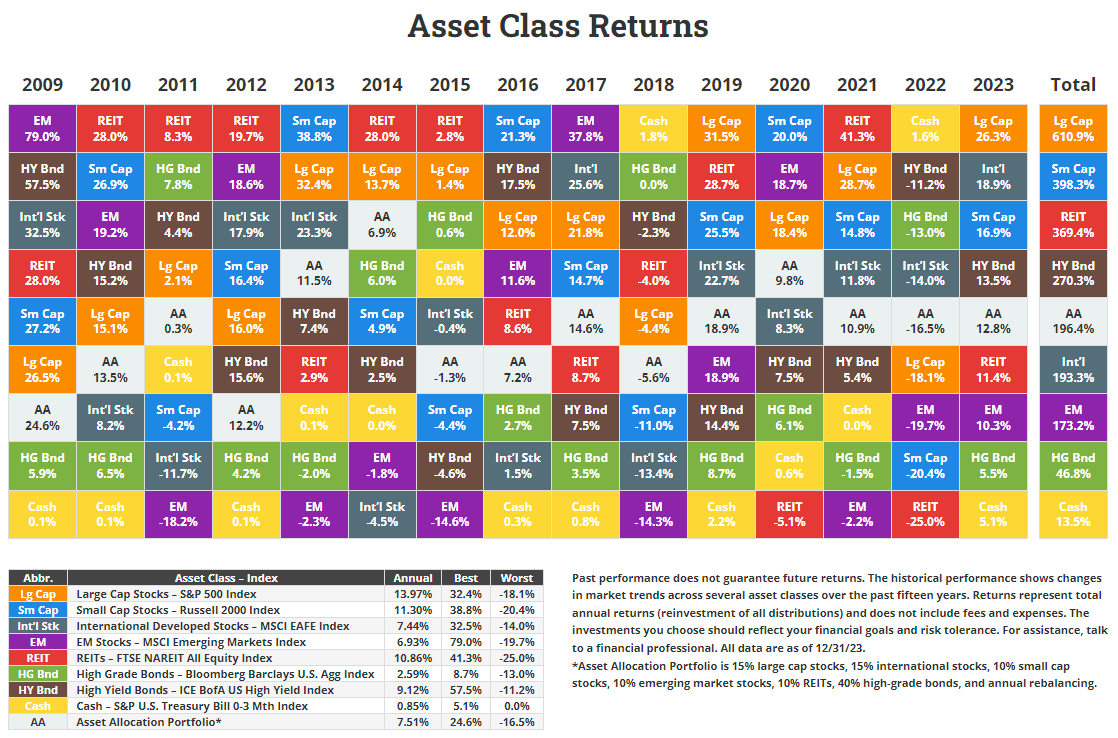

Still, it doesn’t hurt to have financial assets so in the end, you’re not going to be dependent on the government or any one employer. One thing you can count on is your personal investments like RRSPs/RRIFs, TFSAs, and non registered savings. Then of course, if you’re managing your own money , you have to worry about the fear of every retiree: running out of money or losing money if the stock market crashes. Asset allocation is the proper protection there: my own financial advisor recommends 60% fixed income to 40% stocks, I guess we’re close to that. Right now GICs — guaranteed investment certificates — are paying roughly 4 or 5%, depending where you go. If you ladder them so they mature one to five years from now, then you don’t have to worry about the reinvestment risk. You just reinvest whenever they come due at current rates. Continue Reading…