By Noah Solomon

Special to Financial Independence Hub

As I have written in the past, predicting stock market returns is largely an exercise in futility. Over the past several decades, the forecasted returns for the S&P 500 Index provided by Wall Street analysts have been slightly less accurate than someone who would have merely predicted each year that stocks would deliver their long-term average return. Importantly, not one major Wall St. strategist predicted either the tech wreck of the early 2000s or the global financial crisis of 2008-9.

To be clear, I am still adamant that consistently accurate forecasts are beyond the reach of mere mortals (or even quant geeks like me). Any investor who could achieve this feat would reap returns that put Buffett’s to shame. However, there may be some hope on the horizon. Good is not the enemy of great. The objective of any investment process should not be perfection, but rather to make its adherents better off than they would be in its absence.

To this end, I have decided to sin a little and model some of the most commonly cited macroeconomic variables that influence stocks market returns, with the objective of (1) ascertaining whether and how these factors have historically influenced markets and (2) what these variables are signaling for the future.

Don’t Fight the Fed

It is often stated that one shouldn’t fight the Fed. Historically, there has been an inverse relationship between changes in Fed policy and stock prices. All else being equal, increases in the Fed Funds rate have been a headwind for stocks while rate cuts have provided a tailwind.

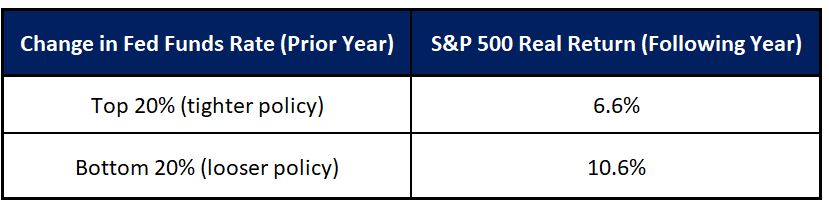

Prior 1-Year Change in Fed Funds Rate vs. 1-Year Real Returns: S&P 500 Index (1960-Present)

As the preceding table illustrates, the difference in one-year real returns following instances when the Fed has been pursuing tighter monetary conditions has on average been 6.6%, as compared to 10.6% following periods when it has been in stimulus mode.

As of the end of June, the Fed increased its policy rate by 3.5% over the past 12 months. From a historical perspective, this change in stance lies within the top 5% of one-year policy moves since 1960 and is the single largest 12-month increase since the early 1980s. Given the historical tendency for stocks to struggle following such developments, this dramatic increase in rates is cause for concern.

Valuation, Voting, and Weighing

Over the past several decades, valuations have exhibited an inverse relationship to future equity market returns. Below-average P/E ratios have generally preceded above-average returns for stocks, while lofty P/E ratios have on average foreshadowed either below-average returns or outright losses.

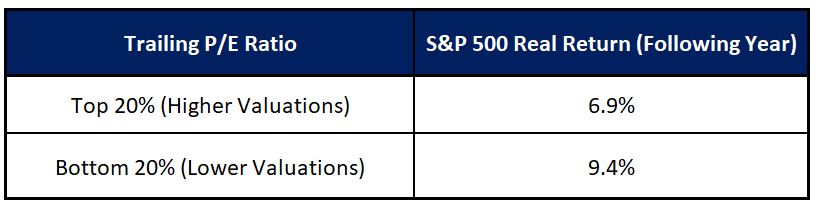

Trailing P/E Ratio vs. 1-Year Real Returns: S&P 500 Index (1960-Present)

Since 1960, when P/E ratios stood in the bottom quintile of their historical range, the S&P 500 produced an average real return over the next 12 months of 9.4% compared with only 6.9% when valuations stood in the highest quintile. Sky high multiples have proven particularly poisonous, as indicated by the crushing bear market which followed the record valuations at the beginning of 2000.

To be clear, valuations have little bearing on the performance of stocks over the short term. However, their ability to predict returns over longer holding periods has been more pronounced. As Buffett stated, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Although valuations are currently nowhere near the nosebleed levels of the tech bubble of the late 1990s, they are nonetheless elevated. With a trailing P/E ratio hovering north of 21, the S&P 500’s valuation currently stands in the 84th percentile of all observations going back to 1960 and is at the very least not a ringing endorsement for strong equity market returns.

From TINA To TARA To TIAGA

At any given point in time, stock market valuations must be considered in the context of the yields offered by high quality money market instruments and bonds. The difference between the earnings yield on stocks and interest rates has historically been positively correlated to future market returns.

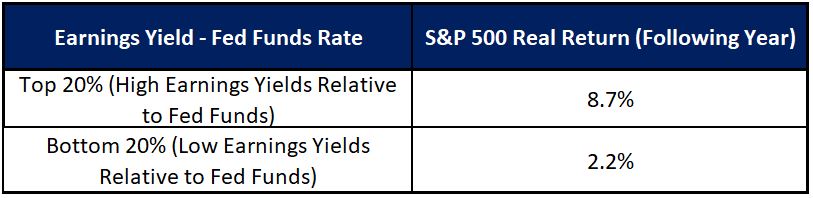

Earnings Yields Minus Fed Funds Rate vs. 1-Year Real Returns: S&P 500 Index (1960-Present)

When the difference between earnings yields and the Fed Funds rate has stood in the top quintile of its historical range, the real return of the S&P 500 Index over the ensuing 12 months has averaged 8.7% versus only 2.2% following times when it has stood in the bottom quintile.

Until the Fed began to aggressively raise rates in early 2022, TINA (there is no alternative) was an oft-cited reason for overweighting stocks within portfolios. Yields on bank deposits and high-quality bonds yielded little to nothing, thereby spurring investors to reach out the risk curve and increase their equity allocations.

As the Fed continued to raise rates, increasingly higher yields made money markets and bonds look at least somewhat attractive for the first time in years, thereby causing market psychology to shift from TINA to TARA (there are reasonable alternatives). Continue Reading…