When you look at the TSX composite, you will notice that the financial and energy sectors make up a large percentage of the index. In fact, the financial sector constitutes over 30% and the energy sector almost 15% of the TSX. If you want a heavier weighting in the consumer staples, consumer discretionary, technology, or health care sectors in your portfolio, it almost always means you have to invest outside of the Canadian market.

For most investors, the easiest way to diversify outside of Canada is utilizing one of the many low-cost index ETFs available. When investing outside of Canada, one of the things to consider is currency exchange rates because they can either work for you or against you.

Hence, investors must answer this very important question: should you utilize currency-hedged ETFs? Or should you ignore the currency exchange rate risk and go with unhedged ETFs?

Hedged vs. unhedged ETFs, which one should you choose? It’s an important and complicated question. Let’s take a closer look.

What is currency hedging?

I’ll be honest. When I first started doing DIY investing, I didn’t understand what currency hedging meant. The term confused me for a very long time.

What does currency hedging mean exactly?

Think of currency hedging like buying car or house insurance. You’re buying and paying for the insurance to protect yourself from an unforeseen event that could cause you to lose a lot of money.

In layman’s terms, currency hedging is a strategy to reduce the effects of currency fluctuations. You’re betting that the foreign currency, usually the US dollar, will weaken against the Canadian dollar. In other words, currency hedging allows you to hold foreign equities without worrying about currency fluctuations and impacting your overall return.

Say you decide to invest in the broad US equity market and the market returned 15% over the past year. During the same year, the US dollar weakened against the Canadian dollar by 10%.

If you invested in an unhedged US broad equity market index ETF, you’d only see a return of 5% minus expenses. The overall return is not 15% because the 10% currency fluctuation has eaten into your returns.

In this scenario, you’d benefit from investing in a hedged US broad equity market index ETF and end up with a return of 15% minus expenses.

Currency hedging isn’t all sunshine and rainbows though. Just as it can work in your favour, as with the above example, it can also go against you. For example, if the US dollar strengthens against the Canadian dollar by 10% during that same time period, you’d end up with a return of 25% minus expenses with an unhedged ETF but only a return of 5% with a hedged ETF. That’s a significant difference!

How do ETF managers hedge currencies?

How do ETF managers hedge and manage risk caused by currency fluctuation? Can’t the average investors like you and me do the same, deploy similar strategies, and avoid paying the ETF management fees?

Well, ETF managers hedge by purchasing assets and instruments to offset currency exposure. ETF managers can buy forward contracts by entering into an agreement to exchange a fixed amount of currency at a future date and a specified rate. They can also use future contracts, currency options to hedge against potential currency risks. These assets and instruments are usually adjusted every month to ensure proper exposure to currency exchange rate risks.

If all that sounds complicated to you, well it is. This is why hedging isn’t something the average investor can easily do. Hedging, as it turns out, is best to leave it to the experts.

Are currency-hedged ETFs good then?

Are currency-hedged ETFs good? Should you always invest in currency-hedged ETFs so you don’t have to worry about currency fluctuation and can sleep like a baby?

Well, the answer is complicated. Turns out, there are many factors that investors need to evaluate before deciding whether to use a currency-hedged ETF or not.

Before we go through these reasons, let’s take a look at the pros and cons of currency-hedged ETFs.

Pros of currency-hedged ETFs

The biggest advantage of currency-hedged ETFs is that you are protecting yourself from any unforeseen (major) currency fluctuation. Essentially, what you see is what you get – you get the true value of the underlying holdings without having to worry about currency exchange rates. This is one of the advantages of CDRs.

For many investors, this can provide peace of mind and simplify investing in foreign markets.

Cons of currency-hedged ETFs

As you can imagine, there’s a cost associated with buying and selling forward and future contracts, options, and other derivatives to offset currency exposure. As a result, currency-hedged ETFs typically have higher management fees compared to their unhedged counterparts.

For example, VSP, the CAD-hedged Vanguard S&P 500 index ETF, has an MER of 0.09%. Meanwhile, its unhedged counterpart, VFV, has an MER of 0.08%.

Even if management fees are the same between hedged and unhedged ETFs, there are potential hidden costs like higher turnover rates.

For example, even though the hedged and unhedged Vanguard US Total Market ETFs, VUS and VUN, have the same MER, VUS, the hedged version, has a portfolio turnover rate of 23.38% while VUN the unhedged version only has a portfolio turnover rate of 8.31%. Higher turnover rates typically mean more transaction costs, which can lead to lower returns in the long run.

Furthermore, currency hedging doesn’t always work for you. When the currency fluctuation goes the other way, currency hedging can lead to a lower return. So be careful when people claim that currency hedging will eliminate all currency risks and that you should ALWAYS invest in currency-hedged products! In my opinion, when it comes to investing, there’s no such thing as ‘ALWAYS.”

Why invest in currency-hedged ETFs?

Given the pros and cons, who is best suited to invest in currency-hedged ETFs? As it turns out, it depends on your risk tolerance and your investment timeline. Here are a few reasons why you’d invest in currency-hedged ETFs.

1. Your investment timeline is short

If we look at the US dollar and Canadian dollar, the all time high was 1.600 in January 2002 and an all time low of 0.948 in October 1959. Over the last 30 years, the historical average has been 1.243.

As of writing, the exchange rate is 1.275 which is stronger than the 30-year historical average. But only slightly! This means there’s a decent chance the US dollar will weaken against the Canadian dollar. However, there are far too many geo-political and geo-economic factors that could possibly arise that no one can accurately predict which way the exchange rate will go in the near, and certainly, in the more distant, future.

If your investment timeline is short, you probably want to protect yourself from the potential weakening of the US dollar. Therefore, it may make sense to pay the extra management fees and use currency-hedged ETFs to smooth out currency fluctuations. On the other hand, if you have a longer investing time horizon, it is probably wise not to go with the hedged option.

2. If you hold a large percentage of foreign equities

If your portfolio is largely allocated to markets outside of Canada, fluctuation in foreign exchange rates can quickly decrease your returns. Using currency-hedged ETFs is a simple way to potentially lock in your returns and not worry about the inverse effects of adverse currency fluctuation.

3. You have low risk tolerance

If you are risk averse, currency hedging can potentially reduce the volatility caused by currency exchange rates. By removing currency exchange rates out of the equation, it’s one less thing to worry about for risk averse investors, allowing them to sleep better at night.

Why invest in unhedged ETFs

On the flip side, there are many reasons why one may want to consider investing in unhedged ETFs. Continue Reading…

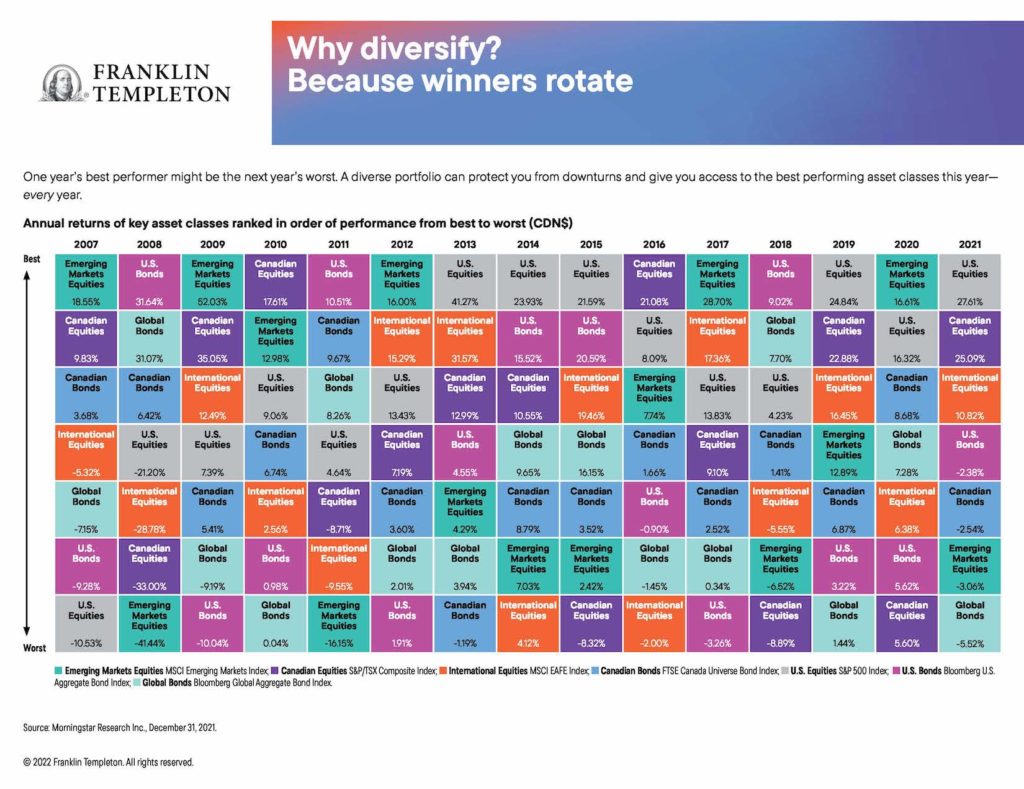

My latest MoneySense Retired Money column addresses a topic I have regularly revisited over the years: annual charts that help investors visualize the top-performing (and bottom-performing!) asset classes. You can find the full column by clicking on the highlighted headline here: Reading the “Annual Returns of Key Asset Classes”—what it means for Canadian investors.

My latest MoneySense Retired Money column addresses a topic I have regularly revisited over the years: annual charts that help investors visualize the top-performing (and bottom-performing!) asset classes. You can find the full column by clicking on the highlighted headline here: Reading the “Annual Returns of Key Asset Classes”—what it means for Canadian investors.