Special to the Financial Independence Hub

So far, the fine wine market remains one of the few bastions of stability in an increasingly volatile investment environment. The Liv-ex 1000, the broadest measure of the global fine wine market, has returned 25.45% this year (as of 30 June).

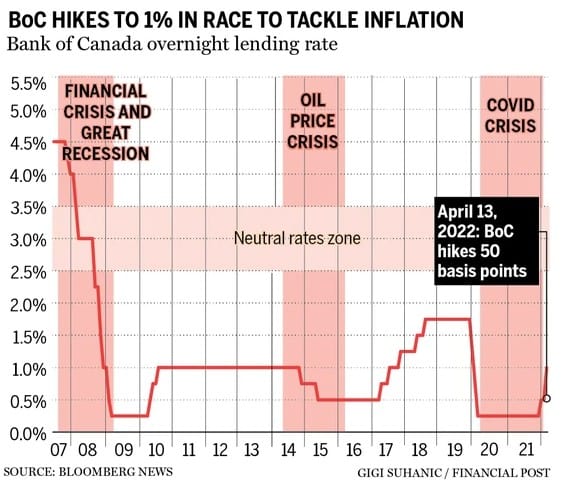

These gains stand in stark contrast to most of the financial markets, where selloffs have hit a wide range of industry sectors, asset classes and geographies. The initial shock from the war in Ukraine has led to surging commodity and food prices, triggering the highest inflation in decades in several major economies including Canada which now stands at 8.1%.

LONG TERM RETURNS

Fine wine boasts a track record of strong growth that has resulted in positive real returns over the long-term.

| Index | Month | YTD | 12-month | 5-year | 10-year | 5 year volatility* |

| Liv-ex 1000 | 0.76% | 11.12% | 25.45% | 50.26% | 92.14% | 1.12% |

| S&P 500 | -8.39% | -20.58% | -11.92% | 56.20% | 177.90% | 4.89% |

| FTSE 100 | -5.76% | -2.92% | 1.87% | -1.96% | 28.69% | 3.92% |

| Nasdaq | -9.00% | -29.51% | -20.96% | 103.72% | 339.79% | 5.72% |

| MSCI AC Asia Pacific | -6.78% | -18.18% | -24.02% | 2.21% | 34.80% | 4.19% |

| Gold in ($/oz) | -1.64% | 0.58% | -0.37% | 42.38% | 12.00% | 3.72% |

| Bitcoin | -37.32% | -56.89% | -43.11% | 703.30% | 297311.94% | 25.18% |

| Bloomberg Commodity | -10.88% | 18.03% | 23.81% | 41.70% | -13.57% | 4.39% |

Source: Investing.com, Liv-ex as of June 30, 2022. Past performance is not indicative of future returns. *Volatility = 5 year standard deviation of monthly returns.

Stable

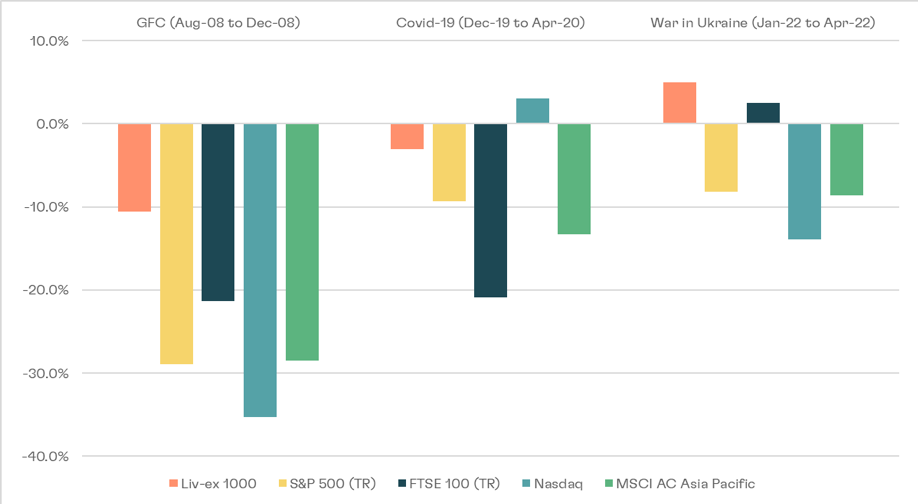

Fine wine’s year-to-date relative strength does not come as a surprise. During previous periods of volatility, such as the COVID-19 outbreak, fine wine prices experienced shorter and less severe downturns compared to equities and faster bounce backs compared to other haven assets, such as bonds.

Figure 2 – Weathering the storm

Fine wine’s relative performance during market downturns

Source: Liv-ex, investing.com. Past performance is not a guarantee of future returns.

This track record may be contributing to fine wine’s recent performance as more buyers, whether collectors or investors, realise fine wine’s ability to form a stable store of value.

Additionally, low fine wine supply levels are also supporting prices. Low harvest yields in 2021 and 2022 have dented production levels for leading fine wine regions, including Bordeaux, Burgundy, Champagne and California, creating fierce competition for top wines. Continue Reading…