By Steve Lowrie, CFA

Special to Financial Independence Hub

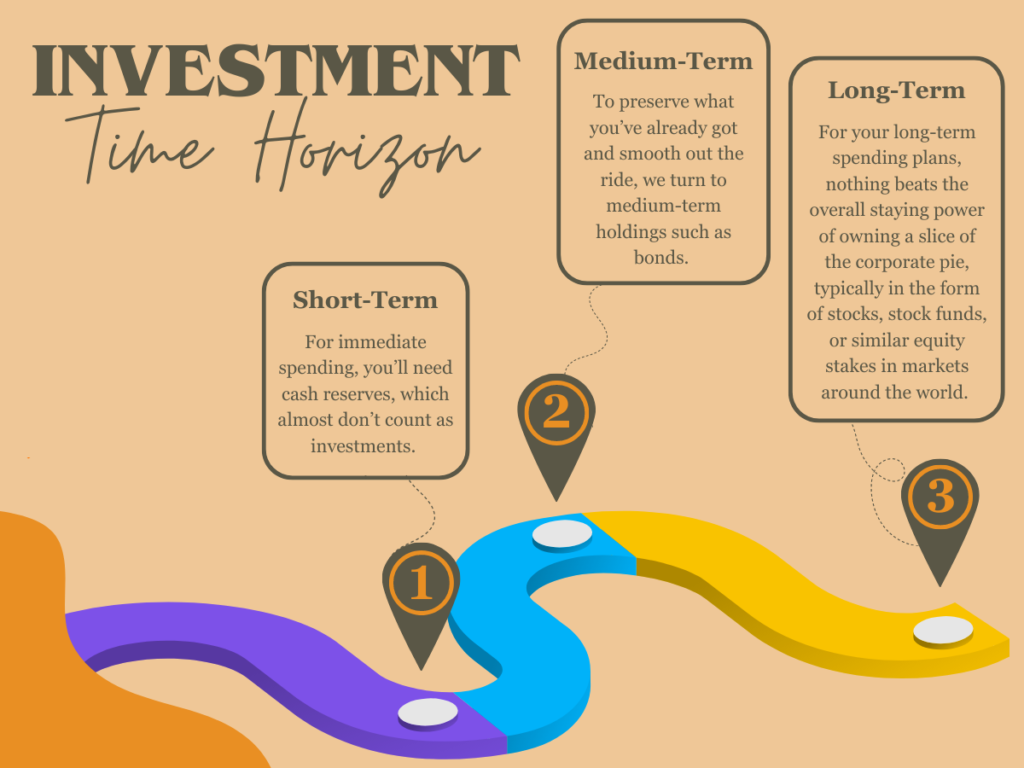

I’ve spent my entire career railing against the dangers of market-timing — i.e., dodging in and out of markets based on current conditions. But there is a time when “timing” of a different sort matters. I’m talking about your investment time horizons.

Today, let’s look at how to use your personal time horizons to successfully separate today’s spending from tomorrow’s future wealth.

Spending and Investing over Time

One of the reasons we advocate for holding a diversified investment portfolio is because your investment horizons are diverse as well:

- For immediate spending, you’ll need cash reserves, which almost don’t count as investments.

- To preserve what you’ve already got and smooth out the ride, we turn to medium-term holdings such as bonds.

- For your long-term spending plans, nothing beats the overall staying power of owning a slice of the corporate pie, typically in the form of stocks, stock funds, or similar equity stakes in markets around the world.

On that last point, global equity markets are relatively dependable in one sense: by delivering on the success of collective human enterprise, they’ve delivered strong, inflation-busting returns in the long run. But these same markets are also quite chaotic in the near-term, with big, unpredictable price swings along the way. This means not all your dollars belong in this arena to begin with: only the ones you’re prepared to invest in for a good, long while. In other words:

Your cash reserves are for spending sooner than later. Your long-term investments are there for your future self, rather than as an ATM-like source for immediate spending.

Market-Timing vs. Financial Planning

How do you determine how long is “long-term” for your investments? Unfortunately, many investors use market-timing instead of personalized financial planning to decide when it’s time to move their money in and out of various positions. They pile into the action when markets surge and flee as they plummet. This is a timeless timing tragedy that foils the ability to preserve, if not grow, wealth over time.

Instead, use your own goals and investment timeframes to decide how much of your wealth to invest in pursuit of higher expected returns, as well as how much to shelter against the uncertainty.

- For upcoming spending needs, your money may be best kept in cash or similar humdrum holdings. That way, it’s there when you need it. The catch is, cash and cash-like reserves aren’t expected to keep pace with inflation over time, which means your spending power gradually shrinks. So …

- For spending that’s still years away, you’ll want to own positions that are expected to generate new wealth, rather than just maintain a status quo. That’s where the wonder of global enterprise comes in — aka, stocks. The catch here is, you must commit to keeping your future money patiently invested and ride out the downturns along the way.

Estimating your Time Horizon

Even if you’re committed to financial planning, it’s surprisingly common to underestimate how much time you’ve actually got to invest. For a couple retiring at age 65, there is a 50% chance one of you will live past age 90, which means your retirement timeline could be 25–30 years, or more. Extend it even further if you’d also like to leave a substantial financial legacy. Continue Reading…