Today’s post highlights one of those investors for investing inspiration…

But let’s back up a bit …

Some time ago … yours truly wrote a controversial post about the intent to live off dividends and distributions from our portfolio.

Indexers gasped and likely unsubscribed to my site!

Well, even though some considerable time has passed since that post my thinking and income goals remain the same – as least in part for semi-retirement planning:

I continue to believe “living off dividends” (and/or distributions) should work out well for us.

And I’m not alone.

For today’s post, I’m profiling a very successful investor …. who not only dreams of dividends but is living the dividend dream right now.

Living The Dividend Dream

Welcome to the site for this latest investor profile, The Dividend Dream.

I look forward to sharing this interesting new investor profile below but first up, a recap about why dividends and distributions continue to matter to me/us on our income journey.

Yes, my approach to live off dividends remains alive and well in 2023!

My dedicated page including many of the stocks I own.

Here are some reasons why some investors couldn’t care less about dividends:

- The trouble with any “live off the dividends” approach is that you’d need to save too much to generate your desired income. Fair.

- Dividends are not magical – there is nothing special about them. Sure, of course they are not magical or free!

- A dollar of dividends is = a one dollar increase in the stock price. True.

- Stock picking (with dividend stocks) is fraught with under performance of the index long-term. I’m not convinced about that.

- You can never possibly know long-term how dividends may or may not be paid by any company. Fair.

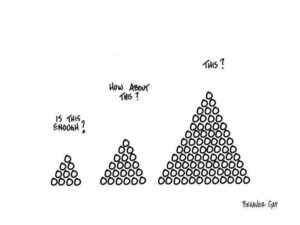

You do need a bunch of capital to generate meaningful dividend income.

Dividends are part of total return.

Stock picking to some degree opens opportunities for market under performance.

However, my responses and approach to some of these items are as follows, since I believe dividend investing offers far more good than harm:

- While market underperformance may occur (that is subjective and up to personal investment success, luck, and other factors that are very difficult to substantiate), dividend investing offers up some essential long-term investing discipline, for me at least, to stay the investing course, including when markets tank in any given year. If anything, I buy more!

- This way of investing provides HUGE motivation and inspiration – to keep investing, in any market climate. The way I see it: money that makes money can make more money.

- Dividend investing, seeing the tangible money flow into our accounts month-after-month, reinforces my belief that nobody cares more about my financial well-being than I do (except for my wife!). Ha.

All kidding aside…dividend investing and having a plan associated with building ever-growing income offers something that some other ways of investing just can’t readily offer: support for the emotional discipline to execute this strategy, come heck or high water, or even until the end of all capitalism as we know it!

But that’s just me and our plan.

Your mileage might vary and that’s OK.

There are many ways to invest and many reasons that folks invest in what they do.

That said, dividend investing is far from any local phenomena.

I reached out to The Dividend Dream for her to share her reasons for investing in dividend paying stocks, including why dividends matter (or not!), and any considerations she has for any investors at any age on their investing journey. [Editor’s note: for now, “she” wishes to remain anonymous, as explained below; hence there is no photo-JC]

Living The Dividend Dream – Dividend Dream – welcome to the site!

Hey hey … thanks for having me. I appreciate the invite!

Before we dive into your investing thesis, why you own what you own, and much more – tell us a bit about yourself.

Well, what can I say. People call me The Dream, Dream Girl, aka Dreamer.

I’m anonymous for now as I’m still working a bit, although I entered into a “freestyle” work optional state this year (2023). I’m a businesswoman, living in the southern United States. My field is strategy and marketing, and I went to a top MBA school. I’m in my mid-40s and am married to a wonderful woman who is a professor. I am the breadwinner in the family – by far – so I feel financially responsible for our future. And yeah … that’s the skinny, essentially.

Interesting!

I feel personal finance is personal – a constant refrain on this site. What I mean by this is: everyone’s financial situation is different, and they have personal reasons to invest the way they do, to realize their individualized goals.

How did you get started with investing?

I actually have been thinking about “retirement” ever since I was a teenager. Really, it’s always been more about being financially secure and independent. My family fell on some hard times and it scared me. I didn’t really have any choice but to rely on myself. I held several jobs in high school and throughout college. So … long story short, after college I started like everyone else with a 401(k) at work, trying to max that out every year. But when I started getting into my 30s that’s when I started to really breakout out of the mold, rolling past 401(k)s into investment accounts where I had complete control and could pick to hold whatever assets I wanted, not just the choices provided by an employer.

Awesome. OK, let’s get into it. Why dividend investing? Why do you invest the way you do? Continue Reading…