By Dale Roberts, cutthecrapinvesting

Special to the Financial Independence Hub

I was the first investment blogger to ‘jump on’ the investment risks that might be created by the coronavirus. In fact, when I first penned on the subject in February of 2020, the virus was not then known as COVID-19. And we were not yet in a global pandemic. New cases were just starting to move around the globe, and most felt that the strange new coronavirus would be contained. Today, I can’t claim that I knew it would result in the first modern pandemic. But I did address the risk, and I did offer some thoughts on how an investor might prepare, if they needed to protect their wealth. Let’s have a look, how did the pandemic portfolio perform?

Here’s the original post from February of 2020.

How to prepare your portfolio for the coronavirus outbreak.

Do nothing, stay the course

That almost goes without saying. You don’t fix a ship in a hurricane offers our friends at Mawer Investments. If you have a solid investment plan, and you are investing within your risk tolerance level —

De-risk your portfolio

This suggestion is controversial to some, but to me it is common sense. Fear was mounting in February of 2020, and the stock markets were offering a minor hissy fit. It is safe to say that most investors are not safe. They are investing outside of their risk tolerance level. These market scares offer the opportunity to discover that you are investing outside of your comfort level.

The timing from February of 2020 to de-risk was still quite favourable.

That would have allowed an investor to move to their risk tolerance level before the market corrected by nearly 35%. While that move to a lower risk portfolio might create lesser returns over time, it can remove the greater risk of permanent losses. Investors are known to too-often sell out in fear near the bottom of the market declines. Of course that’s the complete opposite of – buy low and sell high.

And a typical balanced portfolio would have delivered about 21% to 22% to date, from February of 2020. That’s a greater return compared to the Canadian stock market from that date.

Pandemic portfolio construction

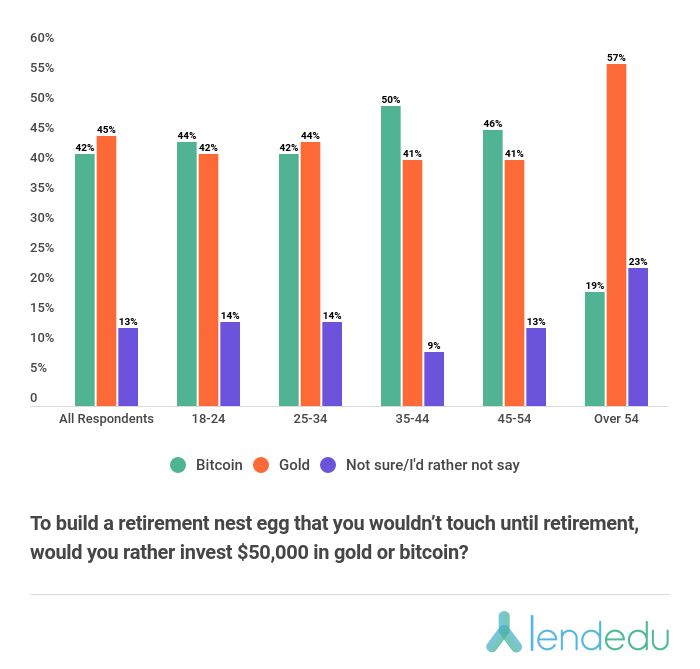

I had suggested that investors consider two of the greater risk-off assets. Risk-off will refer to the defensive investments that protect your portfolio. And typically, investors run to these assets in times of trouble. That influx of dollars can drive up prices.

Gold is known as a safe haven asset.

Gold was the lead image on the original post on how to prepare your portfolio for the pandemic. The precious metal did shine in the pandemic, when needed.

I had suggested that investors consider U.S. long term treasuries. They punch above their weight as risk mangers (keeping an eye on those unruly stock markets.

You’ll find those long term treasuries in the Permanent Portfolio post.

And mostly, at the core is a sensible and well-balanced portfolio. From the original post …

. the best investment strategy is to diversify across geographic locations, asset classes and currencies to protect against the unknowns.

Ray Dalio

That said, one of the beautiful all-in-one balanced asset allocation ETF portfolios would have performed wonderfully. It’s the same story if you held a balanced ETF portfolio.

If an investor had shaded in some gold and long term treasuries, they would have experienced some greater returns, and would have been treated to better risk-adjusted returns.

The pandemic portfolio performance

For demonstration purposes I used the asset allocation offered on the ETF Portfolio page, for a balanced model. You certainly could have (successfully) held a conservative, balanced growth or all-equity model through the pandemic. But for those with a balanced model that holds some risk-off assets, the inclusion of gold and treasuries would have helped the cause. Continue Reading…