While indexing giant Vanguard Group and its Canadian unit are best known for their pioneering work in passive investing, both through index mutual funds and ETFs, they are also significant players in active fund management.

While indexing giant Vanguard Group and its Canadian unit are best known for their pioneering work in passive investing, both through index mutual funds and ETFs, they are also significant players in active fund management.

On Monday, it educated Canadian financial advisors at its 2019 Investment Symposium in Toronto, with the focus on two of the four actively managed mutual funds it first announced last summer.

Vanguard Investments Canada Inc. head Kathy Bock, who took over the position on January 1st, reminded the (mostly fee-based) financial advisors in attendance that Vanguard actually started life as an active manager over 40 years ago, and the firm now actively manages more than US$1.6 trillion globally, which is about a quarter of the firm’s total assets under management of more than US$5.3 trillion. That makes Vanguard the third largest active fund manager in the world. See also this Hub blog on this from last September: Vanguard, the Hidden $1.3 Trillion player in active management. (As you can see, the figure has risen with the markets since then).

These mutual funds do not pay advisors trailer commissions: they are F series funds, which means fee-based advisors are free to set whatever additional fee they negotiate with their clients, just as they do with ETFs. They can also be purchased at some, but not yet all, discount brokerages

The management fees on these actively managed mutual funds are a maximum 0.5%; but in the first year, the fee ranged from 0.34% to 0.4%, which makes them only marginally more costly than Vanguard’s popular asset allocation ETFs that were unveiled just over a year ago (and which spawned several imitators). This is partly achieved through a management fee waiver that can apply, depending on manager performance, as explained at the bottom of this blog.

These mutual funds are managed for Canadians, although the actively managed subadvisors are global active giants, as outlined below. Because they are new funds, they have not disclosed the Management Expense Ratios (MERs).

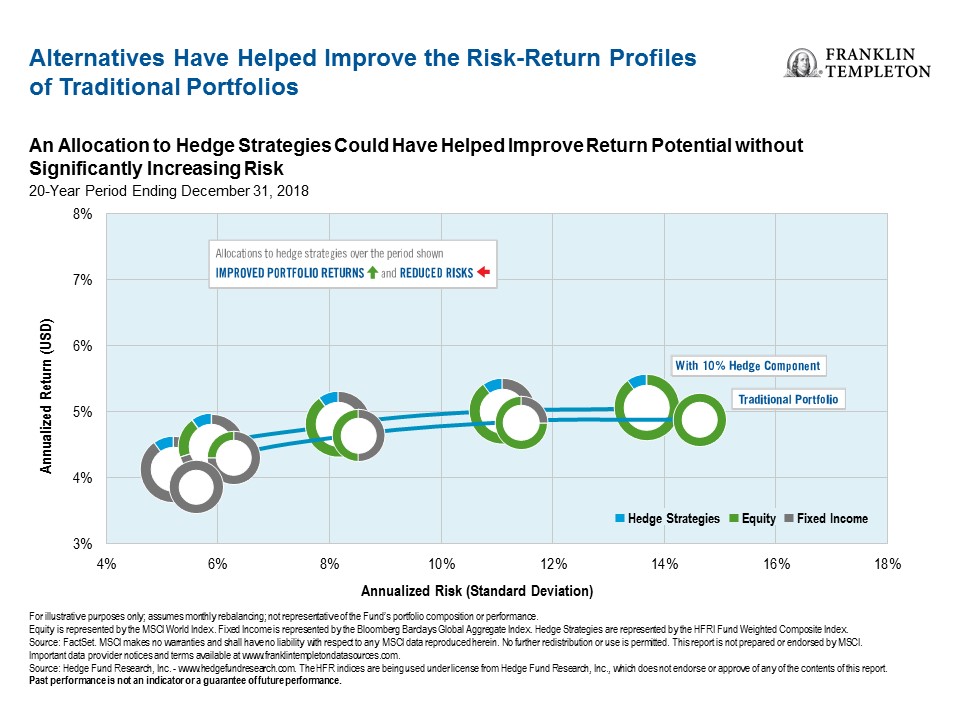

True, at least one advisor in the question period seemed ambivalent about how fee-based advisors can reconcile such an approach to the indexing gospel that Vanguard has so thoroughly dispensed over the years. The answer, according to one of the sub advisors featured, is that the two approaches can complement each other, potentially reducing overall volatility. Buying exclusively ETFs means that over the coming ten years you’re “dooming yourself to a lot of failing businesses,” said Nick Thomas, partner with Baillie Gifford, one of two sub advisors to the Vanguard International Growth Fund, together with Schroder Investment Management North America Inc.

The advisor who posed the question was understandably perplexed by the many studies indexing proponents often cite about how most actively managed funds fail to beat the indexes net of their own additional costs. But the Vanguard managers replied that there are cases where active management can outperform, at least outside the highly liquid U.S. market. Portfolios will be more concentrated than the broad indexes and if an investing thesis pans out, there is an opportunity to “pick” winners at the outset of major trends like A.I. and the cloud, and avoid losers. Presumably managers with skills in combination with good financial advisors can add the kind of “Advisor’s Alpha” to client returns that Vanguard has pioneered.

And if active management makes a good complement to equity portfolios, that should also go for balanced mandates. Indeed, the other highlighted fund was Vanguard Global Balanced Fund, with a 65%/35% equity/fixed-income split managed by Wellington Management Canada ULC, headquartered in Boston. The proportion can move to 60/40 or 70/30, depending on market view. It was launched with the other three mutual funds on June 20, 2018.

China tech big focus of Vanguard International Growth Fund

Most of the discussion centered on the Chinese holdings of Vanguard International Growth Fund: China accounts for 20% of the fund’s geographic allocation. The top ten holdings include three Chinese web giants: Alibaba Group Holding Ltd., Tencent Holdings Ltd and Baidu Inc. It also holds Amazon.com Inc. and MercadoLibre Inc. among its top holdings.

Schroders manager John Chisholm is slightly underweight Emerging Markets and market weight China. Baillie Gifford’s Thomas is slightly more enthusiastic, being overweight both Emerging Markets and China. But both see promising long-term growth prospects for the major Chinese web giants. Asked about the current Trump trade war and accusations of theft of American intellectual property, the managers downplayed this as a U.S. interpretation of the facts. Thomas said he views both Tencent and Alibaba as “superior to Facebook or Amazon.”

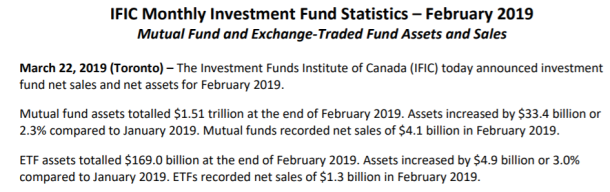

And here’s the sales figures for the ETF industry for RRSP season:

And here’s the sales figures for the ETF industry for RRSP season: