By Sa’ad Rana, Senior Associate – ETF Online Distribution, BMO ETFs

(Sponsor Content)

Indexed investing, when done properly can be an efficient and low-cost way of gaining exposure to various markets. Investment vehicles such as exchange-traded funds (ETFs), make it possible for individuals to invest in these indexes, i.e., the Nasdaq-100 index.

Nasdaq-100 & Exposures

Launched in 1985, the Nasdaq-100 is one of the world’s most well-known large-cap growth indexes. The companies in the Nasdaq-100 include over 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. It is mainly comprised of technology, consumer, and health companies – with a slight exposure to industrials and telecom.

When looking at what is powering economic growth in the 21st century, we look to those new economy sectors that are highly digital. These are disproportionately tech or consumer companies like Amazon, Microsoft, and Google. This index gives you exposure to the biggest Nasdaq-listed names, along with others that follow closely behind these leaders in technology.

Nasdaq-100 vs S&P 500 Volatility & Performance

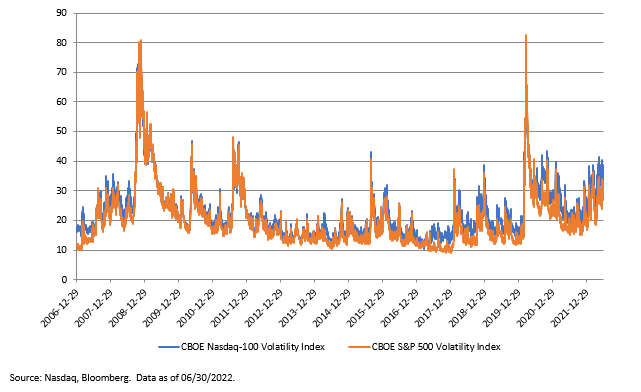

When looking at volatility, one may think of the Nasdaq as being a more growth-oriented index, and if looking at returns alone, these have certainly shown to be significant over the years. Investors may assume that the indexes’ higher performance leads to higher volatility compared to other leading indexes. However, if we take a look at the chart below, which is more of a longer-term picture, you are getting a pretty significant consistent volatility range. Of course, if you look at this year in comparison inflation has been at the forefront of headlines, growth-oriented companies have been taking a harder hit than more cash-up-front companies: you see more volatility in the Nasdaq this year vs the S&P 500.

Both the Nasdaq-100 and the S&P 500 have had very similar volatility over last 15+ years

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

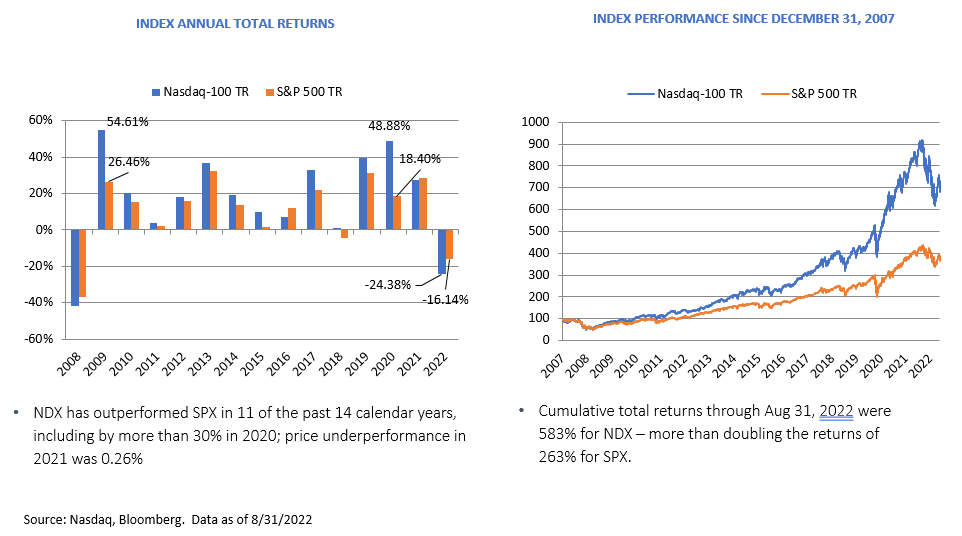

The big story for everyone is the performance of the Nasdaq-100 vs. the S&P 500. The long-term performance of the Nasdaq-100 shows an upward trend. If we look at post-2008, generally monetary policy had been very supportive of market growth, and companies had been able to invest in research, helping them grow over time. You see this reflected in the Nasdaq-100, where thanks to the underlying companies in this index, there is outperformance. The chart below showcases this quite well. It tells us that the Nasdaq-100 is a valuable holding in a portfolio based on performance.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

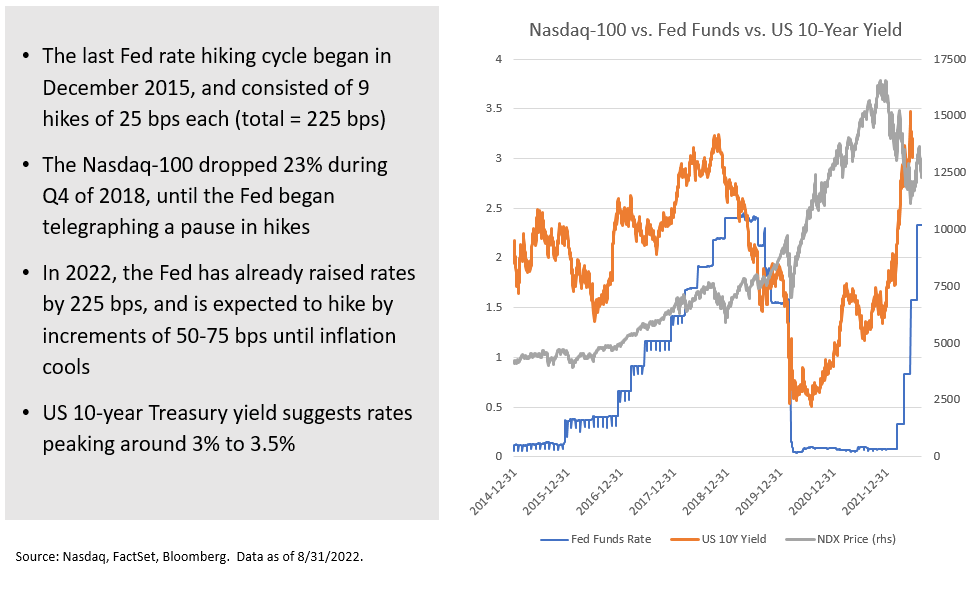

Market Considerations: Performance vs Interest Rates

The chart below shows what happened the last time rates went up by a similar amount. You can see a gradual stairway up from almost 0% to about 2.5%. You can see the dip in the NDX price (grey line), which looks like a blip, almost not noticeable (but it was 23%). This isn’t very far from the drawdown this year to date. Albeit the Fed is raising rates much faster.

Based on experience, the Fed may keep rates high until inflation gets under control into that sort of two to three per cent range. The question for investors is, what happens to stocks if rates get to 3%, 4% or maybe 5% and perhaps stay at that level for a few years? This is where it is imperative to look at the amount of debt these companies have on their balance sheet, how much the interest costs will go up and what their earnings power looks like. Will they be able to remain competitive with the price of everything rising? Will consumers continue to pay for these products vs. downsizing or even substituting for cheaper alternatives? Continue Reading…