Zero Trust Architecture (ZTA) is fast becoming the security model of choice as businesses worldwide recognize the need to better protect their networks and assets in light of today’s growing remote workforce.

By Anthony DeCristofaro

Special to the Financial Independence Hub

For many organizations, remote work began as a pandemic-induced novelty. More than a year later, however, it has become the new normal. Even when the world officially reopens, a large number of employees who have experienced the perks of working from home will no doubt be requesting the flexibility to continue doing so – that is, if their employers actually plan on transitioning back to a physical workplace.

Remote work presents new data security challenges: even for top-notch VPN

Granted, a reliable VPN will substantially lower your chances of being hacked. However, as the past year has shown us, even the most highly rated VPNs are far from foolproof. While they’ve always had their fair share of vulnerabilities (thus the need for constant updating), VPNs have been under constant assault since the pandemic began.

For example, one extremely sophisticated attack compromised more than 900 Pulse Secure enterprise VPN servers enabling the attackers to gain access, steal account credentials, and exfiltrate other sensitive data belonging to victim organizations.

The more employees using your VPN, the greater your network’s vulnerability

Pre-COVID, you had maybe 10% of employees using your VPN one or two days a week. Now, you likely have 90% of employees or more using your VPN five days a week. Each one of these employees creates a new point of vulnerability.

Your VPN can’t protect remote workers from malicious cyber activity. If just one compromised employee uses your VPN, you could soon have yourself an intruder. It’s a company’s worst nightmare and an attacker’s dream come true.

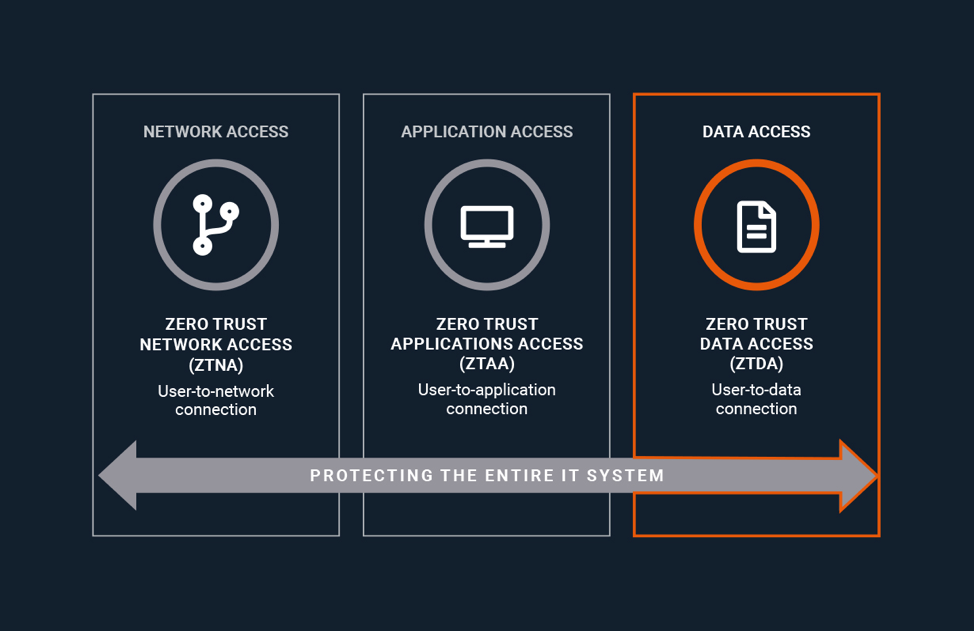

Zero Trust Architecture (ZTA) is the way forward

According to Gartner IT Research, “by 2022, 80% of new digital business applications opened up to ecosystem partners will be accessed through zero trust network access,” and 60% of enterprises will transition most of their remote access VPN solutions to ZTNA by 2023.

Unlike VPNs, platforms that operate with Zero Trust Architecture (ZTA) assume that security breaches happen – and rightly so. Take the recent Colonial Pipeline incident.

In May 2021, the fuel operator responsible for carrying 2.5 million barrels of fuel per day was temporarily shut down after being held for ransom by cybercriminals. This, combined with similar cyberattacks on SolarWinds, Microsoft Exchange, and others, prompted The White House to issue an Executive Order in support of a zero trust approach to security. Continue Reading…