By Danielle Neziol, BMO ETFs

(Sponsor Content)

Canadians are facing a lot of sticker shock lately. My grocery bill was how much? My mortgage payment is going to increase by what per cent? Don’t even ask me what it costs to fill up my car these days. With more money going to living expenses, it has become harder to save than ever. One simple way to get ahead is to be more aware of what we are spending — especially in times like these — and to review our monthly expenses to see where there are opportunities to make cuts.

Our investment portfolios should be viewed no differently. If you are an investor who holds a mutual fund or an exchange traded fund (ETF) there are fees attached to your investments. It would be prudent to review the cost structure of the funds you hold to ensure that the fees make sense relative to the fund’s investment mandate. It would also be wise to review the cost of the funds you hold to see if that fee is competitive relative to similar products in the market. Fees detract from total portfolio returns, so anything an investor can do to manage these costs can help keep more money in their pockets.

Management Fees and MERs

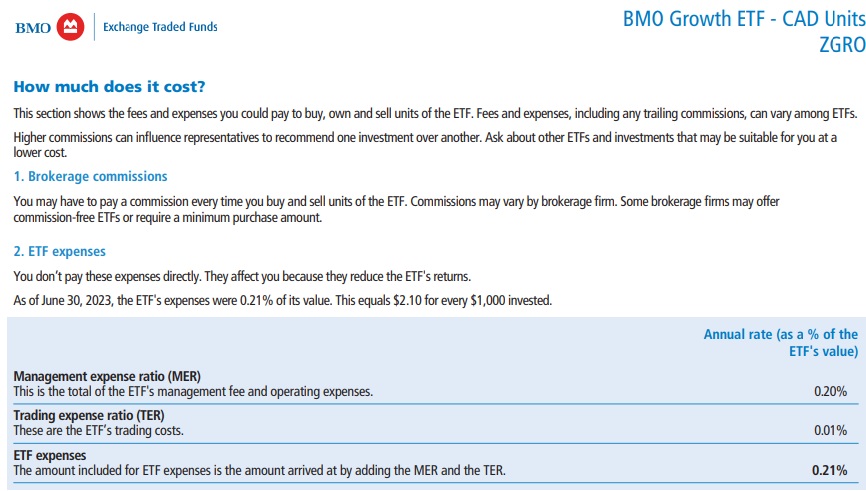

Every investment fund has a management fee. This is the cost a fund manager charges to manage the portfolio operationally (buy and sell securities, rebalance, etc). The Management Expense Ratio (MER) is the bottom-line cost to the investor. It includes any taxes charged to the fund, as well as any added fees (such as leverage). An investor can look up the management fee and MER within the Fund Facts and ETF Facts of their funds. These are regulatory documents that can be found for every fund issued in Canada. Some asset managers advertise very low management fees but have higher, less advertised, MERs, so investors should always do their due diligence on the total fund cost to fully understand the bottom-line payment that they are making every year.

The MER is subtracted from daily returns. Therefore, it has a direct impact on the total return of the fund. And as investors we know that overtime, our total returns help build our overall wealth. Therefore, the lower the fee on the investment, the more money there will be for the investor at the end of their investment period.

Comparing Fees

Once investors are aware of the fees they are paying for their investment products, they have the ability to “shop around” to see if there are any products that may be a better fit in their portfolios or which offer lower fees. When comparing fees it’s important to understand what you’re getting for in return for what you’re paying for. Broad market index funds generally have the lowest fees in the market. For example the BMO S&P 500 Index ETF (ZSP) has an MER of 0.09%. Index funds tend to have the lowest fees because operationally they are easier to manage. A Portfolio Manager will go out and buy the stocks within a particular index, and rebalance when needed.1 Continue Reading…