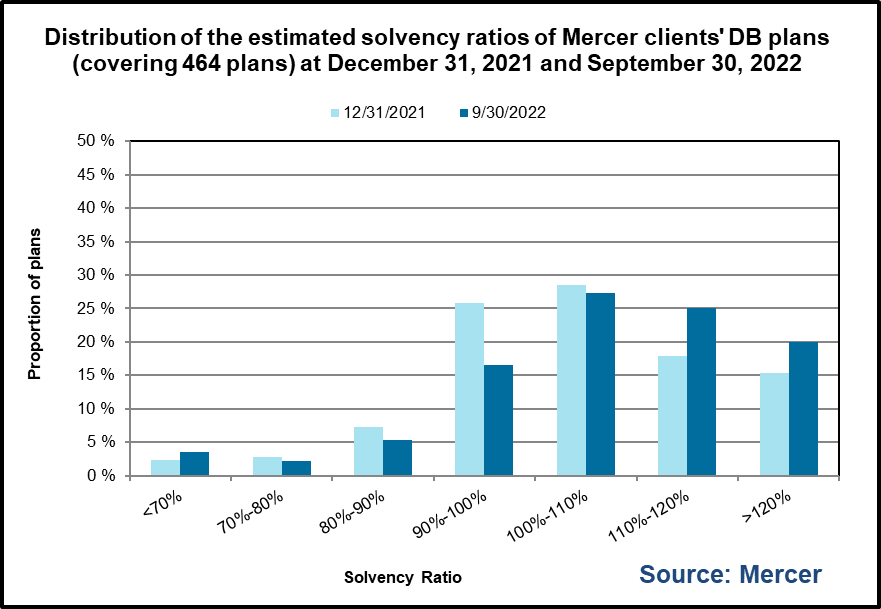

Unlike the first half of 2022, the financial position of most defined benefit (DB) pension plans “decreased slightly” in the third quarter, as they were buffeted by inflation and volatile stock markets. Investment returns were mostly negative in the quarter, and yields on long-term bonds were lower at the end of the quarter than they were at the beginning, according to The Mercer Pension Health Pulse (MPHP), released on Monday.

The MPHP tracks the median solvency ratio of the DB pension plans in Mercer’s pension database, which decreased from 109% as at June 30, 2022, to 108% as at September 30, 2022.

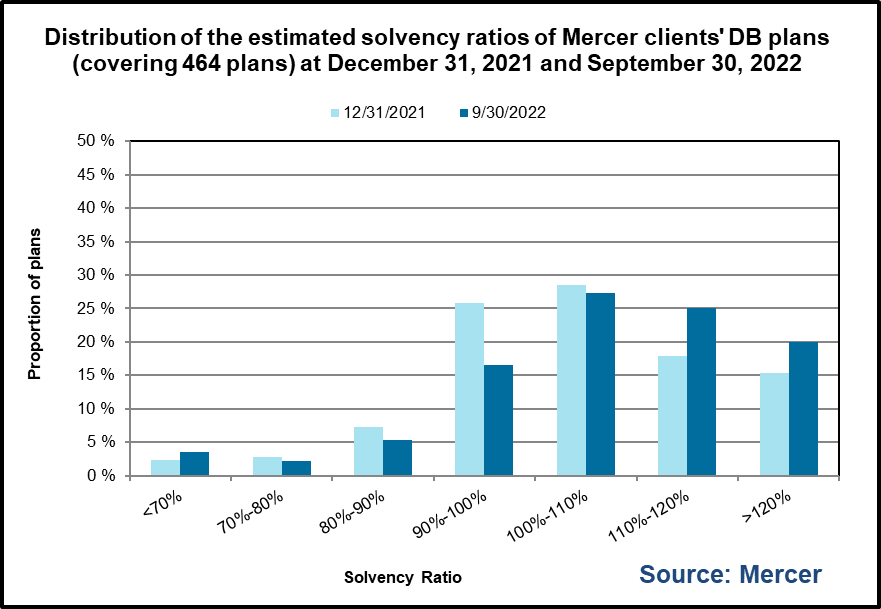

Of the plans in Mercer’s pension database, at the end of Q3:

- 72% of plans were estimated to be in a surplus position on a solvency basis,(vs. 73% at the end of Q2)

- 17% of plans were estimated to have solvency ratios between 90% and 100%,(vs. 16% at the end of Q2)

- 5% have solvency ratios between 80% and 90% (unchanged from Q2), and

- 6% have solvency ratios less than 80%. (also unchanged from Q2).

In a press release, the Calgary-based Principal and leader of Mercer’s Wealth business, Ben Ukonga, said that “In spite of the significant market volatility, the financial health of most DB plans would have experienced only a slight decline in the third quarter of 2022. As for what can be expected for the remainder of the year, plan sponsors should continue to expect significant volatility.”

Mercer says experts “urge caution and encourage plan sponsors to be prepared for anything, with more volatility on the horizon. Markets will most likely remain volatile in the short to medium term due to numerous risks such as the continued war in Ukraine, the upcoming US midterm elections, the potential confrontation between the US and China over the status of Taiwan, risks of a global energy supply shortfall, and of course, the ongoing inflationary environment.”

Continued short- and medium- term volatility

Markets will most likely continue to remain volatile in the short to medium term due to numerous global risks, including the war in Ukraine (and the Russian Government’s actions in response to Ukraine’s recent successes on the battlefront, such as the recent annexation of parts of Ukraine in violation of International Law, and the geo-political fallouts from these actions). Mercer is also cautious about the upcoming US mid-term elections, the increasing political gridlock and polarization in the US, and the potential for a confrontation between the US and China over the status of Taiwan. The recent volatility in the UK currency and bond markets and the risk of contagion to other markets.

Mercer also sees risks from a global energy supply shortfall, and the effect such a shortfall would have on the global economy: “… plan sponsors should pay attention to the risks associated with energy insecurity in Europe – such as the risk of the Russian Government using Russian gas supplies against Europe in retaliation to sanctions on Russia, and the effects on European economies if their energy supplies are curtailed.”

Inflation at levels not seen in 30 years

With inflation running at levels not seen in over 30 years, central banks globally are “on an aggressive monetary tightening mission in order to get inflation under control. Will they succeed without triggering a hard-landing global recession? Will higher interest rates make governments, corporations and households unable to meet the interest payments on debts they accumulated during the very long period of low interest rates? This could lead to an increase in bankruptcies and crowding out spending and investments, further exacerbating the risks of a hard landing global recession.”

As workers see a decline in the purchasing power of their wages, there will be increased pressures on employers for higher wages, Mercer says. “Sponsors of indexed DB plans will see increases in the cost of these arrangements, and sponsors of non-indexed DB plans may face pressure from their pensioner groups to provide ad hoc cost of living adjustments. Coupled with labour shortages, some employers may have no choice but to increase their labour costs. And companies that are unable to pass these increased costs to their customers will face profit margin pressures and reduced profitability, hurting their future economic outlook.”

Covid still poses macro risk

The global health landscape also poses a macro risk, Mercer says. “As the western hemisphere is entering the winter months, will a new vaccine-resistant strain of the COVID-19 virus appear? And how will governments and citizens deal with such a resurgence? Will the Chinese government continue with its zero-COVID policy? And how much of a negative impact will this policy, along with what some would call draconian lock down measures, have on the Chinese economy? And how deep will the negative knock-on effects be on China’s trading partners?” Continue Reading…