(Sponsor Content)

The global sports industry is worth between US$400 to $500 billion a year and in the five years leading up to the pandemic in 2020 had been growing at an annual rate of 14%, according to NewZoo.

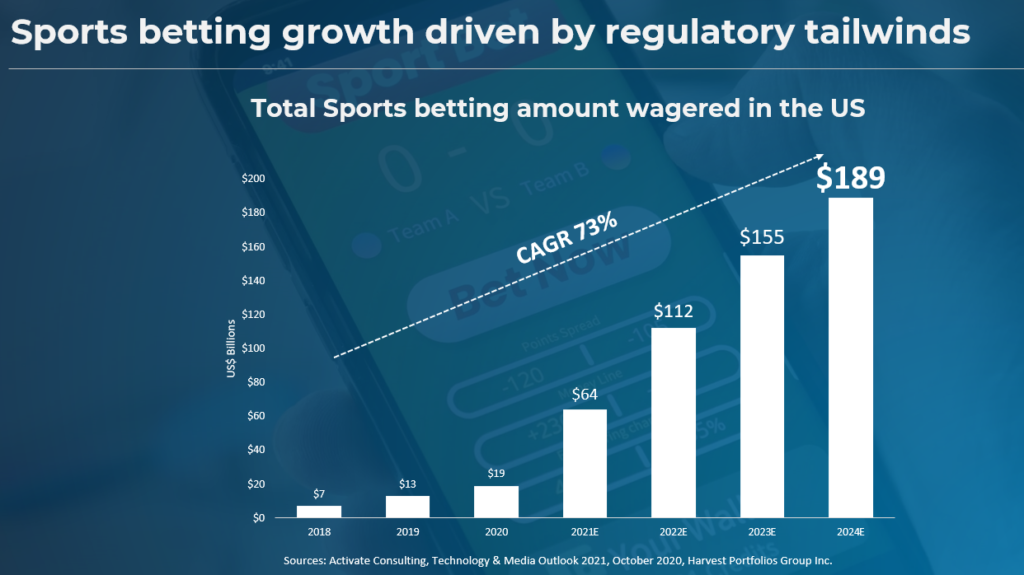

When it comes to pro teams, in addition to game tickets, fans buy branded merchandise and play in fantasy leagues. The teams earn more TV revenues as they advance in playoffs. But sports business is more than that. It also involves online gaming, gaming software developers and internet sports gambling. These last areas are large and rapidly growing. While the United States is the world’s largest sports market, China and other parts of Asia are emerging as leaders in eGaming and iGambling.

Harvest Portfolios Groups Ltd. has launched the Harvest Digital Sports & Entertainment Index ETF (TSX:HSPN) to take advantage of the attractive dynamics of this sector.

In the interview below, Harvest CEO Michael Kovacs discusses the ETF, the sector’s outlook and how the ETF aligns with the Harvest philosophy of creating value through ownership of the best global businesses.

Financial Independence Hub [The Hub henceforth]: Why did you launch the Harvest Digital Sports & Entertainment Index ETF?

Michael Kovacs [MK henceforth]: Sports entertainment is a global industry with great growth characteristics. It is regaining a foothold after more than a year of empty stadiums and lost revenues. At the same time, there have been bright spots, including new forms of sports entertainment such as online gaming and internet gambling where the pandemic has been a catalyst.

At Harvest, we seek to identify trends like this. Sports is one that continues to grow globally and also offers reopening opportunities as the pandemic issues decline.

MK: It is passively managed ETF with 40 global stocks that follows the Solactive Sports & Entertainment Index. The companies are publicly traded, mostly in North America, with some in Europe. The ETF is diversified across five areas of the sporting world, with different weightings for each area. It is rebalanced quarterly.

MK: As mentioned, the ETF is diversified to capture all segments of the industry. Professional sports organizations make up five of the 40 holdings, or 12.5%. There are a number that either trade under their own name or as part of companies that own them. The English soccer team Manchester United Plc is one example. It is one of the game’s strongest brands. It is listed in New York and has a market capitalization of about US$2.7 billion. Another example is Liberty Media-Liberty Formula One. which trades on Nasdaq. It owns the Formula 1 racing and has a market cap of US $18 billion. Madison Square Gardens Sports Corp. is another. It owns the New York Rangers of the NHL and the NBA’s New York Knicks. It has a market cap of US $4.5 billion. These are examples of some of the great sporting franchises out there.

MK: Yes, they are. Together they are about 38% of the ETF. Ticketing makes up five holdings or 12.5%. There are a lot of companies that people would recognize. Live Nation Entertainment Inc. owns the familiar ticketing company, Ticketmaster. Live Nation is a global company that manages ticket sales and resales and also owns and operates entertainment venues and manages careers. In fact, they own and operate several of the premier venues that many Canadians have attended concerts and events.

Sports equipment and apparel is another 10 holdings or 25% of the ETF. Again, many of the companies are household names. Nike Inc. is a global leader in the manufacture and marketing of athletic shoes, branded clothes and equipment. It also sells baseball bats and balls, tennis rackets and golf clubs. Nike’s annual revenues are more than US $18 billion.Adidas which is the second largest global sports apparel company after Nike, owns Reebok and part of the German soccer club Bayern München. Cross ownership like this gives these companies incredible brand power. Continue Reading…